Question: Please show all work using excel. Question 1 The CSI educational company is reviewing two projects to make a determination as to which is more

Please show all work using excel.

Please show all work using excel.

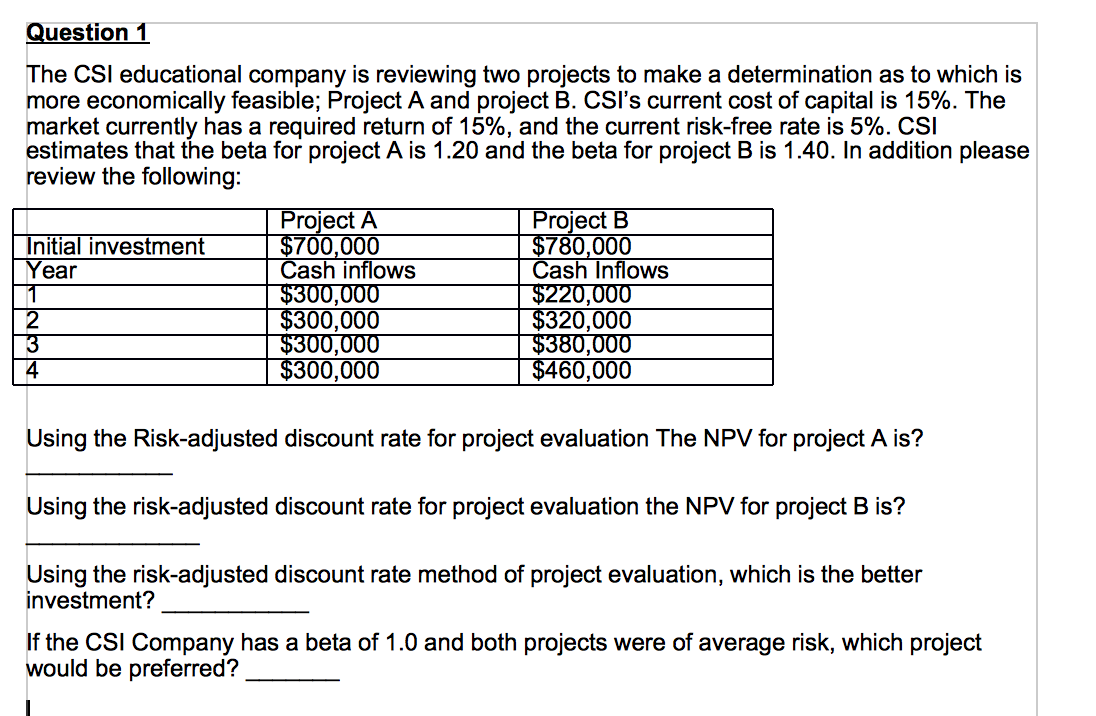

Question 1 The CSI educational company is reviewing two projects to make a determination as to which is more economically feasible; Project A and project B. CSI's current cost of capital is 15%. The market currently has a required return of 15%, and the current risk-free rate is 5%. CSI estimates that the beta for project A is 1.20 and the beta for project B is 1.40. In addition please review the following: Project A Project B Initial investment $700,000 $780,000 Year Cash inflows Cash Inflows 1 $300,000 $220,000 2 $300,000 $320,000 3 $300,000 $380,000 4 $300,000 $460,000 Using the Risk-adjusted discount rate for project evaluation The NPV for project A is? Using the risk-adjusted discount rate for project evaluation the NPV for project B is? Using the risk-adjusted discount rate method of project evaluation, which is the better investment? If the CSI Company has a beta of 1.0 and both projects were of average risk, which project would be preferred

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts