Question: please show all work using formulas 2. Red Hill Industrial is expected to pay a dividend at the end of the year of $2.00. You

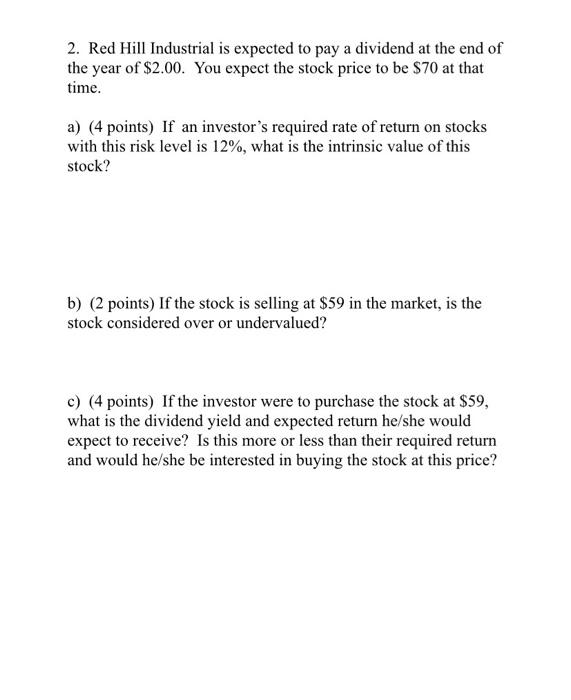

2. Red Hill Industrial is expected to pay a dividend at the end of the year of $2.00. You expect the stock price to be $70 at that time. a) (4 points) If an investor's required rate of return on stocks with this risk level is 12%, what is the intrinsic value of this stock? b) (2 points) If the stock is selling at $59 in the market, is the stock considered over or undervalued? c) (4 points) If the investor were to purchase the stock at $59, what is the dividend yield and expected return he/she would expect to receive? Is this more or less than their required return and would he/she be interested in buying the stock at this price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts