Question: please show all work using formulas Part II: Problems: Show all of your work for maximum credit. (63 points) 1. Orca Bay Industrial has a

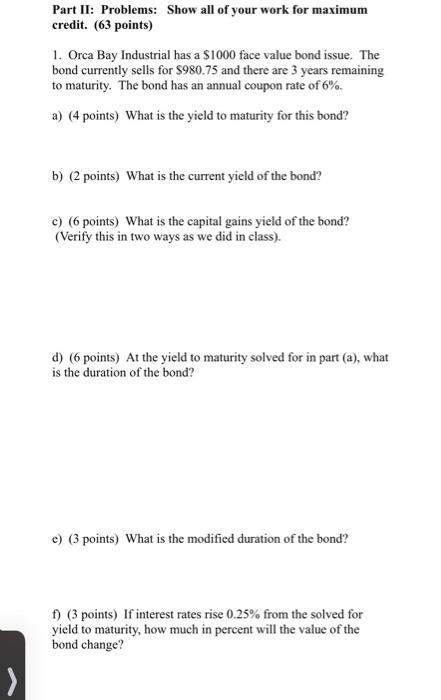

Part II: Problems: Show all of your work for maximum credit. (63 points) 1. Orca Bay Industrial has a $1000 face value bond issue. The bond currently sells for $980.75 and there are 3 years remaining to maturity. The bond has an annual coupon rate of 6%. a) (4 points) What is the yield to maturity for this bond? b) (2 points) What is the current yield of the bond? c) (6 points) What is the capital gains yield of the bond? (Verify this in two ways as we did in class). d) (6 points) At the yield to maturity solved for in part (a), what is the duration of the bond? e) (3 points) What is the modified duration of the bond? D) (3 points) If interest rates rise 0.25% from the solved for yield to maturity, how much in percent will the value of the bond change? >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts