Question: please show all work using formulas, thank you 11% 1. (3 points) You have the following stocks over the past 5 years. The holding period

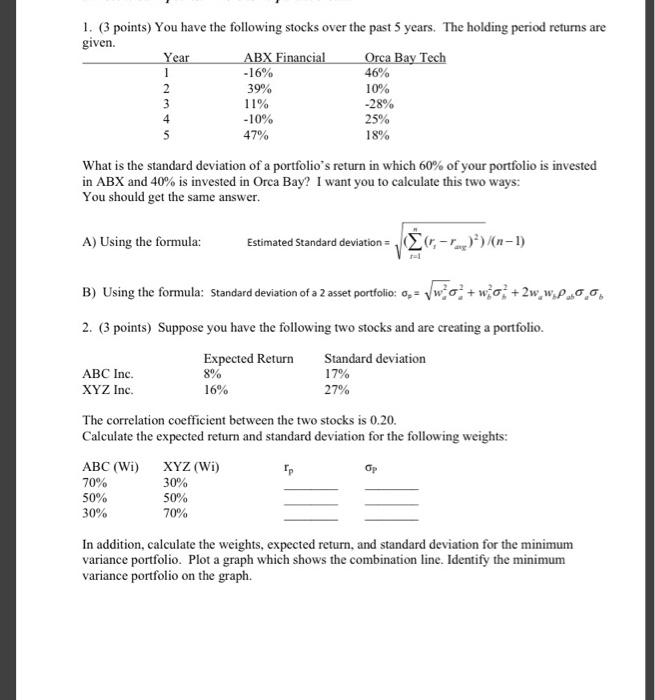

11% 1. (3 points) You have the following stocks over the past 5 years. The holding period returns are given. Year ABX Financial Orca Bay Tech 1 -16% 46% 2 39% 10% 3 -28% 4 -10% 25% 5 47% 18% What is the standard deviation of a portfolio's return in which 60% of your portfolio is invested in ABX and 40% is invested in Orca Bay? I want you to calculate this two ways: You should get the same answer. mo A) Using the formula: Estimated Standard deviation = 3C-W))(n-1) B) Using the formula: Standard deviation of a 2 asset portfolio: 0 - VW.02 + wc +2ww.2.00 2. (3 points) Suppose you have the following two stocks and are creating a portfolio Expected Return Standard deviation ABC Inc. 17% XYZ Inc. 16% 27% The correlation coefficient between the two stocks is 0.20. Calculate the expected return and standard deviation for the following weights: 8% GP ABC (Wi) 70% 50% 30% XYZ (Wi) 30% 50% 70% In addition, calculate the weights, expected return, and standard deviation for the minimum variance portfolio. Plot a graph which shows the combination line. Identify the minimum variance portfolio on the graph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts