Question: Please show all work. Want written work with formulas. (No Excel) 4) Kurt's Cabinets is looking at a project that will require $100,000 in fixed

Please show all work. Want written work with formulas.

(No Excel)

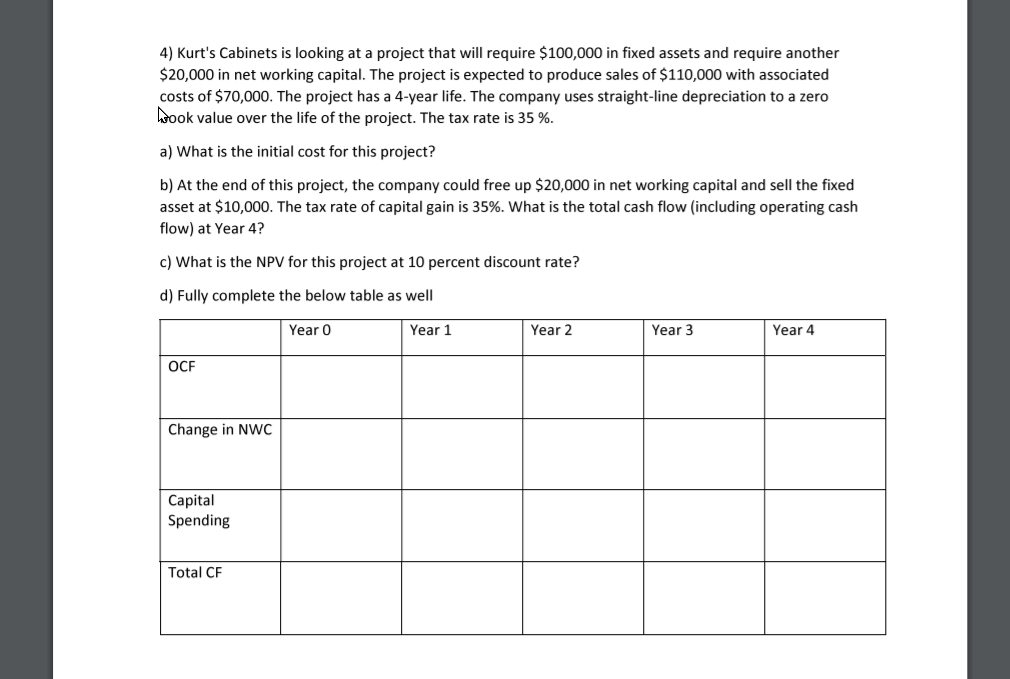

4) Kurt's Cabinets is looking at a project that will require $100,000 in fixed assets and require another $20,000 in net working capital. The project is expected to produce sales of $110,000 with associated costs of $70,000. The project has a 4-year life. The company uses straight-line depreciation to a zero hook value over the life of the project. The tax rate is 35 %. a) What is the initial cost for this project? b) At the end of this project, the company could free up $20,000 in net working capital and sell the fixed asset at $10,000. The tax rate of capital gain is 35%. What is the total cash flow (including operating cash flow) at Year 4? c) What is the NPV for this project at 10 percent discount rate? d) Fully complete the below table as well Year 0 Year 1 Year 2 Year 3 Year 4 OCF Change in NWC Capital Spending Total CF 4) Kurt's Cabinets is looking at a project that will require $100,000 in fixed assets and require another $20,000 in net working capital. The project is expected to produce sales of $110,000 with associated costs of $70,000. The project has a 4-year life. The company uses straight-line depreciation to a zero hook value over the life of the project. The tax rate is 35 %. a) What is the initial cost for this project? b) At the end of this project, the company could free up $20,000 in net working capital and sell the fixed asset at $10,000. The tax rate of capital gain is 35%. What is the total cash flow (including operating cash flow) at Year 4? c) What is the NPV for this project at 10 percent discount rate? d) Fully complete the below table as well Year 0 Year 1 Year 2 Year 3 Year 4 OCF Change in NWC Capital Spending Total CF

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts