Question: Please show all work. Will like for correct answers. Problem 22-15 Management of Braden Boats, Inc. is considering an expansion in the firm's product line

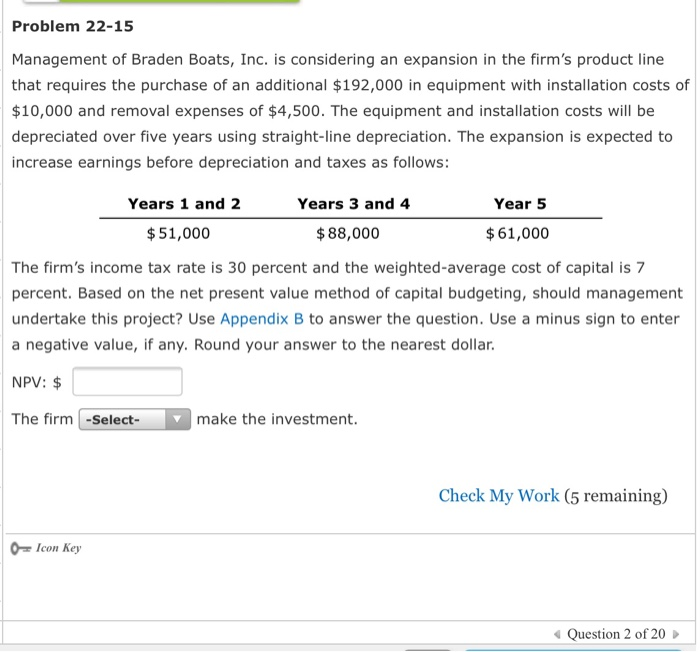

Problem 22-15 Management of Braden Boats, Inc. is considering an expansion in the firm's product line that requires the purchase of an additional $192,000 in equipment with installation costs of $10,000 and removal expenses of $4,500. The equipment and installation costs will be depreciated over five years using straight-line depreciation. The expansion is expected to increase earnings before depreciation and taxes as follows: Years 1 and 2 Years 3 and 4 Year 5 $51,000 $88,000 $61,000 The firm's income tax rate is 30 percent and the weighted-average cost of capital is7 percent. Based on the net present value method of capital budgeting, should management undertake this project? Use Appendix B to answer the question. Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar NPV:$ The firm-Select- make the investment. Check My Work (5 remaining) Question 2 of 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts