Question: Please show all work with steps. Use excel if needed. Round accordingly as instructed Thanks. You are choosing between two projects The cash flows for

Please show all work with steps. Use excel if needed. Round accordingly as instructed Thanks.

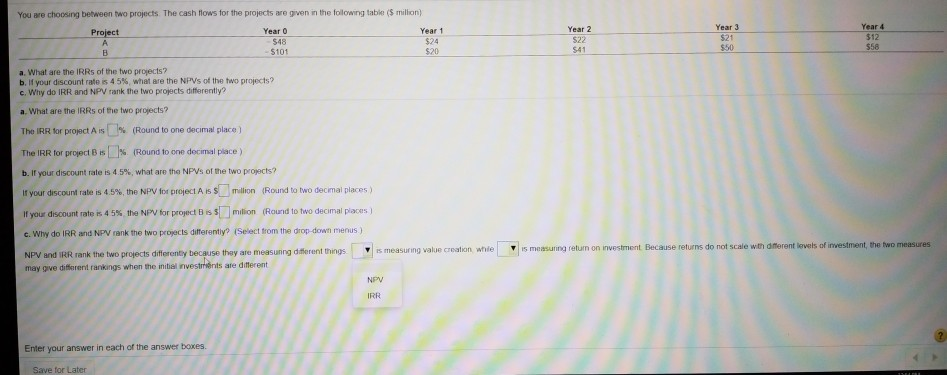

You are choosing between two projects The cash flows for the projects are given in the following table ($ million) Year 3 $21 $50 Year 4 512 558 Year 2 S22 S41 Year 1 $24 $20 Year 0 $48 $101 Project a. What are the IRRs of the two projects? b. If your discount rate es 4 5%, 'what are the NPVs of the two proyects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects? The IRR for project A is The IRR for project B is (Round to one decimal place ) b. If your discount rate is 4 5%, what are the NPVs of the two projects? If your discount rate is 4.5%, the NPV for proiect A is S-million (Round to two decmal places ) If your c. Why do IRR and NPV rank the two projects difterently? (Select trom the drop-down menus ) n% (Round to one decimal place ) milion (Round to two decimal places ) discount raters 45% the NPVfor projedB n we I5 measuring return on investment Because returns do not scale wth different levels of investment, the two NPV and IRR rank the two projects differenty because thay are measuning diferent things may give difirent rankings when the initiel nvestments are ditterent s measuring value creation NPV IRR Enter your answer in each of the answer boxes. Save for Later Year 0 Year 2 520 S41 550 a. What are the IRRs of the two projects? may give different rankings when the initial nwestments are different IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts