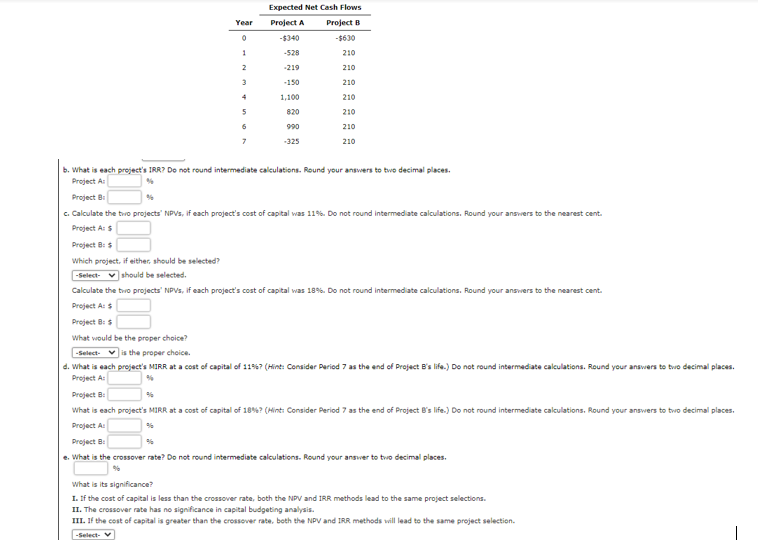

Question: Please show all work Year Expected Net Cash Flows Project A Project B -$340 -$630 -528 210 1 2 -219 210 3 -150 4 1,100

Please show all work

Year Expected Net Cash Flows Project A Project B -$340 -$630 -528 210 1 2 -219 210 3 -150 4 1,100 820 5 6 7 210 210 210 210 210 990 -325 b. What is each project's IRR? Do not round intermediate calculations. Round your answers to two decimal places. Project A: Project B: c. Calculate the two projects" NPVS, if each project's cost of capital was 11%. Do not round Intermediate calculations. Round your answers to the nearest cent. Project A:s Project B: Which project, if either should be selected? - Select should be selected. Calculate the two projects" NPVs, if each project's cost of capital was 18%. Do not round intermediate calculations. Round your answers to the nearest cent. Project A: $ Project B: $ What would be the proper choice? - Select is the proper choice d. What is each project's MIRR at a cost of capital of 1157 (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answers to tvio decimal places. Project A: Project B. What is each project's MIRR at a cost of capital of 18%? (Hint: Consider Period 7 as the end of Project B's life.) Do not round intermediate calculations. Round your answers to two decimal places, Project A Project B: 9 e. What is the crossover rate? Do not round intermediate calculations. Round your answer to the decimal places, What is its significance? I. If the cost of capital is less than the crossover rate, both the NPV and IRR methods lead to the same project selections. II. The crossover rate has no significance in capital budgeting analysis. III. If the cost of capital is greater than the crossover rate, both the NPV and IRR methods will lead to the same project selection. -Selv

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts