Question: please show all work/formulas in excel! will upvote once all answered. thank you in advance! Suppose you wish to retire 33 years from today. You

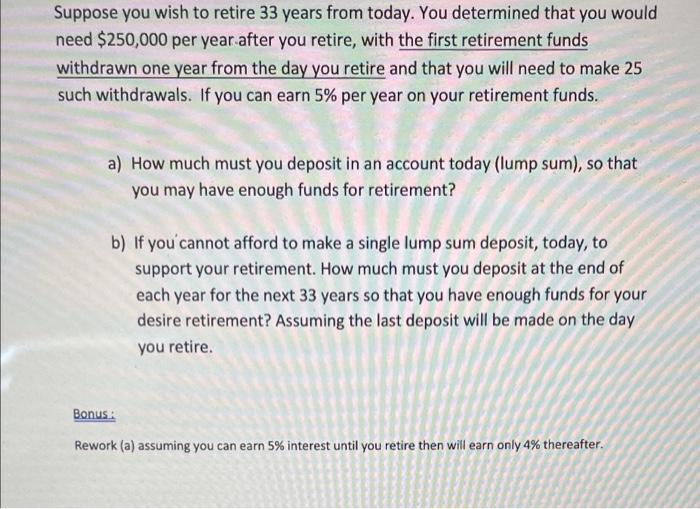

Suppose you wish to retire 33 years from today. You determined that you would need $250,000 per year after you retire, with the first retirement funds withdrawn one year from the day you retire and that you will need to make 25 such withdrawals. If you can earn 5% per year on your retirement funds. a) How much must you deposit in an account today (lump sum), so that you may have enough funds for retirement? b) If you cannot afford to make a single lump sum deposit, today, to support your retirement. How much must you deposit at the end of each year for the next 33 years so that you have enough funds for your desire retirement? Assuming the last deposit will be made on the day you retire. Bonus: Rework (a) assuming you can earn 5% interest until you retire then will earn only 4% thereafter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts