Question: please show all working and write equation QUESTION 6 _{10 MARKS) a) The yield to maturity on zero-coupon bonds with one-year maturity is 3%, the

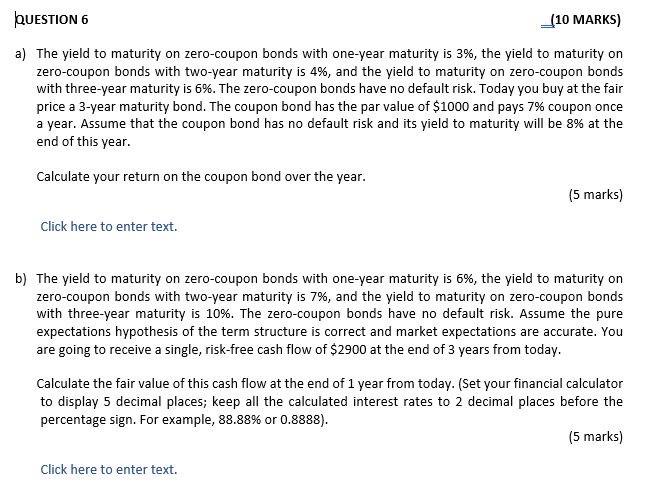

QUESTION 6 _{10 MARKS) a) The yield to maturity on zero-coupon bonds with one-year maturity is 3%, the yield to maturity on zero-coupon bonds with two-year maturity is 4%, and the yield to maturity on zero-coupon bonds with three-year maturity is 6%. The zero-coupon bonds have no default risk. Today you buy at the fair price a 3-year maturity bond. The coupon bond has the par value of $1000 and pays 7% coupon once a year. Assume that the coupon bond has no default risk and its yield to maturity will be 8% at the end of this year. Calculate your return on the coupon bond over the year. (5 marks) Click here to enter text. b) The yield to maturity on zero-coupon bonds with one-year maturity is 6%, the yield to maturity on zero-coupon bonds with two-year maturity is 7%, and the yield to maturity on zero-coupon bonds with three-year maturity is 10%. The zero-coupon bonds have no default risk. Assume the pure expectations hypothesis of the term structure is correct and market expectations are accurate. You are going to receive a single, risk-free cash flow of $2900 at the end of 3 years from today. Calculate the fair value of this cash flow at the end of 1 year from today. (Set your financial calculator to display 5 decimal places; keep all the calculated interest rates to 2 decimal places before the percentage sign. For example, 88.88% or 0.8888). (5 marks) Click here to enter text

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts