Question: please show all working for first question I Net income / taxable income question 2 Kia is an employee of a Canadian controlled private corporation

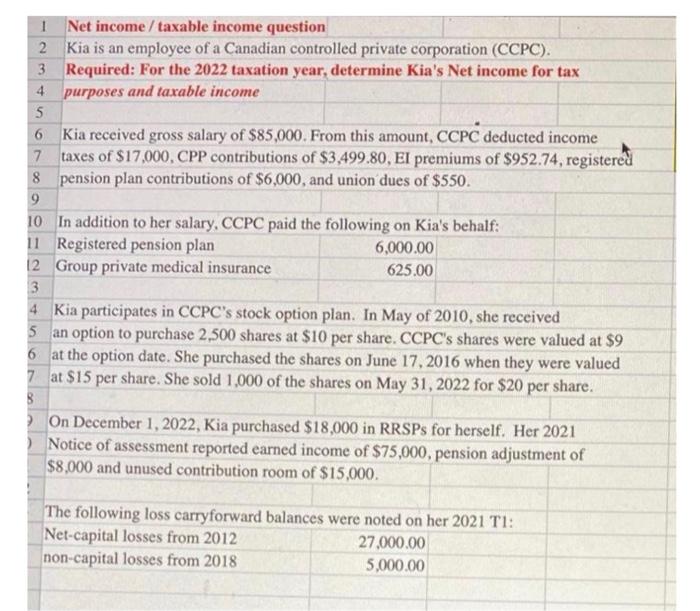

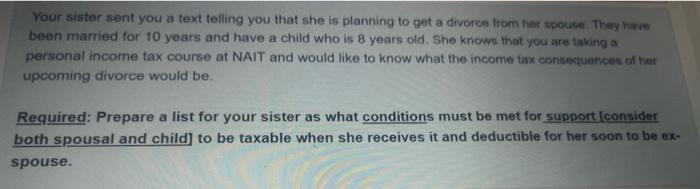

I Net income / taxable income question 2 Kia is an employee of a Canadian controlled private corporation (CCPC). 3 Required: For the 2022 taxation year, determine Kia's Net income for tax 4 purposes and taxable income 5 Kia received gross salary of $85,000. From this amount, CCPC deducted income taxes of $17,000, CPP contributions of $3,499.80, EI premiums of $952.74, registered pension plan contributions of $6,000, and union dues of $550. In addition to her salary, CCPC paid the following on Kia's behalf: 4 Kia participates in CCPC's stock option plan. In May of 2010, she received 5 an option to purchase 2,500 shares at $10 per share. CCPC's shares were valued at $9 6 at the option date. She purchased the shares on June 17, 2016 when they were valued 7 at $15 per share. She sold 1,000 of the shares on May 31, 2022 for $20 per share. On December 1, 2022, Kia purchased $18,000 in RRSPs for herself. Her 2021 Notice of assessment reported earned income of $75,000, pension adjustment of $8,000 and unused contribution room of $15,000. The following loss carryforward balances were noted on her 2021 T1: Net-capital losses from 2012 non-capital losses from 2018 27,000.005,000.00 Your sister sent you a text telling you that she is planning to get a divorce from her kpouse. They have been married for 10 years and have a child who is 8 years old. She knows that you are taking a personal income tax course at NAIT and would like to know what the income tax consequences of her upcoming divorce would be. Required: Prepare a list for your sister as what conditions must be met for support consider both spousal and child] to be taxable when she receives it and deductible for her soon to be exspouse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts