Question: Please Show all working please This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary

Please Show all working please

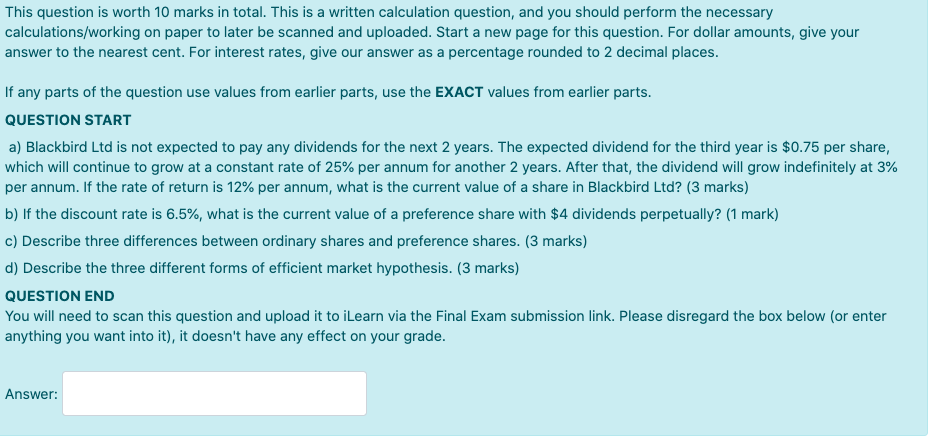

This question is worth 10 marks in total. This is a written calculation question, and you should perform the necessary calculations/working on paper to later be scanned and uploaded. Start a new page for this question. For dollar amounts, give your answer to the nearest cent. For interest rates, give our answer as a percentage rounded to 2 decimal places. If any parts of the question use values from earlier parts, use the EXACT values from earlier parts. QUESTION START a) Blackbird Ltd is not expected to pay any dividends for the next 2 years. The expected dividend for the third year is $0.75 per share, which will continue to grow at a constant rate of 25% per annum for another 2 years. After that, the dividend will grow indefinitely at 3% per annum. If the rate of return is 12% per annum, what is the current value of a share in Blackbird Ltd? (3 marks) b) If the discount rate is 6.5%, what is the current value of a preference share with $4 dividends perpetually? (1 mark) c) Describe three differences between ordinary shares and preference shares. (3 marks) d) Describe the three different forms of efficient market hypothesis. (3 marks) QUESTION END You will need to scan this question and upload it to iLearn via the Final Exam submission link. Please disregard the box below (or enter anything you want into it), it doesn't have any effect on your grade

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts