Question: Please show all working, thanks! Problem 1 (22 marks) Bea's Bikes Limited is an all-equity firm that has an EBIT of ( $ 450,000 ).

Please show all working, thanks!

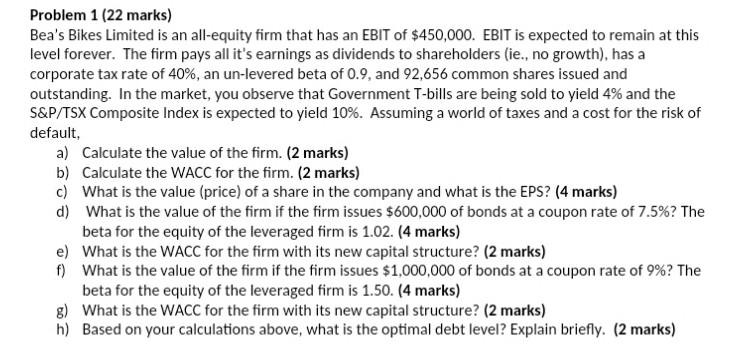

Problem 1 (22 marks) Bea's Bikes Limited is an all-equity firm that has an EBIT of \\( \\$ 450,000 \\). EBIT is expected to remain at this level forever. The firm pays all it's earnings as dividends to shareholders (ie., no growth), has a corporate tax rate of \40, an un-levered beta of 0.9 , and 92,656 common shares issued and outstanding. In the market, you observe that Government T-bills are being sold to yield \4 and the \\( \\mathrm{S} \\& \\mathrm{P} / \\mathrm{TSX} \\) Composite Index is expected to yield 10\\%. Assuming a world of taxes and a cost for the risk of default, a) Calculate the value of the firm. (2 marks) b) Calculate the WACC for the firm. ( 2 marks) c) What is the value (price) of a share in the company and what is the EPS? (4 marks) d) What is the value of the firm if the firm issues \\( \\$ 600,000 \\) of bonds at a coupon rate of \7.5 ? The beta for the equity of the leveraged firm is 1.02 . ( 4 marks) e) What is the WACC for the firm with its new capital structure? (2 marks) f) What is the value of the firm if the firm issues \\( \\$ 1,000,000 \\) of bonds at a coupon rate of \9 ? The beta for the equity of the leveraged firm is 1.50 . (4 marks) g) What is the WACC for the firm with its new capital structure? (2 marks) h) Based on your calculations above, what is the optimal debt level? Explain briefly. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts