Question: Please show all your work and make sure its easy to read. Its due urgent so if I can copy and paste it, it will

Please show all your work and make sure its easy to read. Its due urgent so if I can copy and paste it, it will be perfect. Please answer fast ill give a thumbs up. Thank you.

Please show all your work and make sure its easy to read. Its due urgent so if I can copy and paste it, it will be perfect. Please answer fast ill give a thumbs up. Thank you.

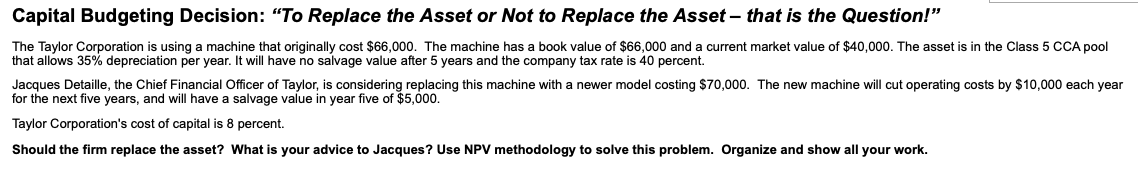

Capital Budgeting Decision: "To Replace the Asset or Not to Replace the Asset - that is the Question!" The Taylor Corporation is using a machine that originally cost $66,000. The machine has a book value of $66,000 and a current market value of $40,000. The asset is in the Class 5 CCA pool that allows 35% depreciation per year. It will have no salvage value after 5 years and the company tax rate is 40 percent. Jacques Detaille, the Chief Financial Officer of Taylor, is considering replacing this machine with a newer model costing $70,000. The new machine will cut operating costs by $10,000 each year for the next five years, and will have a salvage value in year five of $5,000. Taylor Corporation's cost of capital is 8 percent. Should the firm replace the asset? What is your advice to Jacques ? Use NPV methodology to solve this problem. Organize and show all your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts