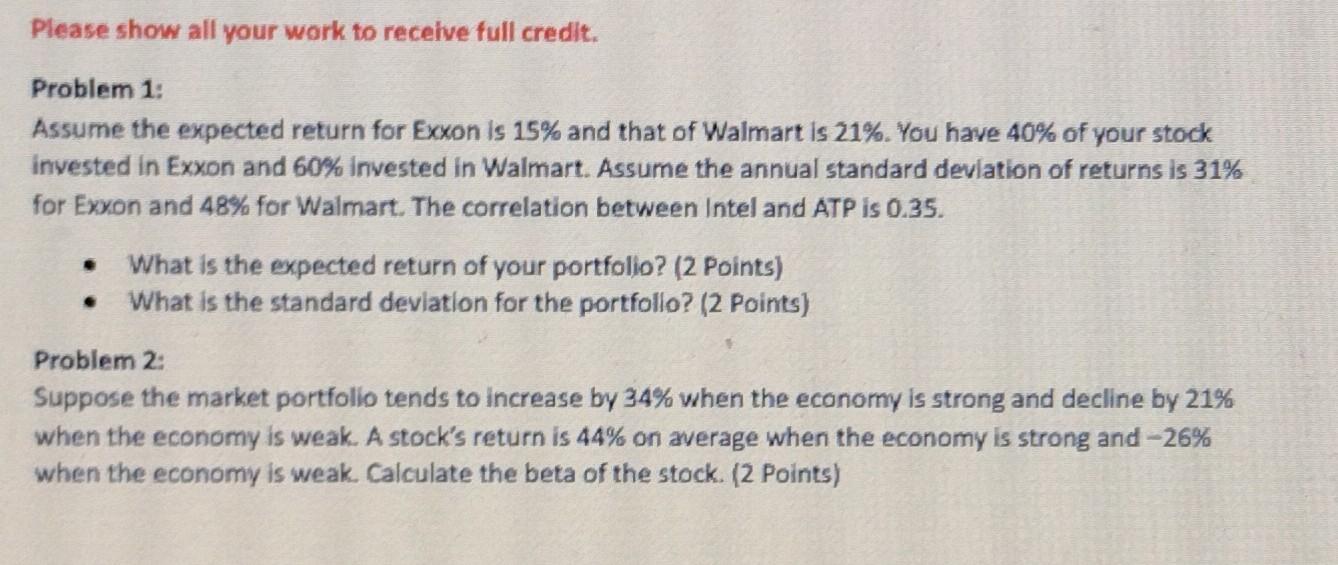

Question: Please show all your work to recelve full credit. Problem 1: Assume the expected return for Exxon is 15% and that of Walmart is 21%.

Please show all your work to recelve full credit. Problem 1: Assume the expected return for Exxon is 15% and that of Walmart is 21%. You have 40% of your stock invested in Exxon and 60% invested in Walmart. Assume the annual standard deviation of returns is 31% for Exxon and 48% for Walmart. The correlation between Intel and ATP is 0.35 . - What is the expected return of your portfolio? (2 Points) - What is the standard deviation for the portfollo? (2 Points) Problem 2: Suppose the market portfolio tends to increase by 34% when the economy is strong and decline by 21% when the economy is weak. A stock's return is 44% on average when the economy is strong and 26% when the economy is weak. Calculate the beta of the stock. (2 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts