Question: Please show all your working Question #5: Taxable account vs RRSP (8 marks) Assume that you earned $90,000 this year but you expect to earn

Please show all your working

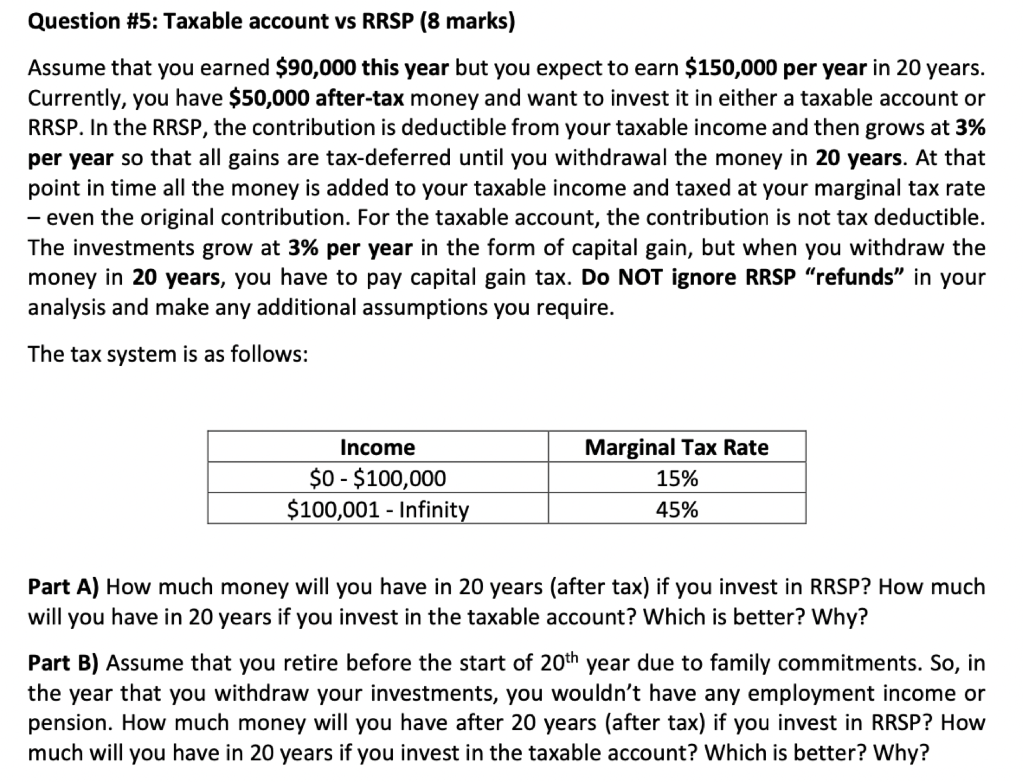

Question #5: Taxable account vs RRSP (8 marks) Assume that you earned $90,000 this year but you expect to earn $150,000 per year in 20 years. Currently, you have $50,000 after-tax money and want to invest it in either a taxable account or RRSP. In the RRSP, the contribution is deductible from your taxable income and then grows at 3% per year so that all gains are tax-deferred until you withdrawal the money in 20 years. At that point in time all the money is added to your taxable income and taxed at your marginal tax rate - even the original contribution. For the taxable account, the contribution is not tax deductible. The investments grow at 3% per year in the form of capital gain, but when you withdraw the money in 20 years, you have to pay capital gain tax. Do NOT ignore RRSP refunds in your analysis and make any additional assumptions you require. The tax system is as follows: Income $0 - $100,000 $100,001 - Infinity Marginal Tax Rate 15% 45% Part A) How much money will you have in 20 years (after tax) if you invest in RRSP? How much will you have in 20 years if you invest in the taxable account? Which is better? Why? Part B) Assume that you retire before the start of 20th year due to family commitments. So, in the year that you withdraw your investments, you wouldn't have any employment income or pension. How much money will you have after 20 years (after tax) if you invest in RRSP? How much will you have in 20 years if you invest in the taxable account? Which is better? Why? Question #5: Taxable account vs RRSP (8 marks) Assume that you earned $90,000 this year but you expect to earn $150,000 per year in 20 years. Currently, you have $50,000 after-tax money and want to invest it in either a taxable account or RRSP. In the RRSP, the contribution is deductible from your taxable income and then grows at 3% per year so that all gains are tax-deferred until you withdrawal the money in 20 years. At that point in time all the money is added to your taxable income and taxed at your marginal tax rate - even the original contribution. For the taxable account, the contribution is not tax deductible. The investments grow at 3% per year in the form of capital gain, but when you withdraw the money in 20 years, you have to pay capital gain tax. Do NOT ignore RRSP refunds in your analysis and make any additional assumptions you require. The tax system is as follows: Income $0 - $100,000 $100,001 - Infinity Marginal Tax Rate 15% 45% Part A) How much money will you have in 20 years (after tax) if you invest in RRSP? How much will you have in 20 years if you invest in the taxable account? Which is better? Why? Part B) Assume that you retire before the start of 20th year due to family commitments. So, in the year that you withdraw your investments, you wouldn't have any employment income or pension. How much money will you have after 20 years (after tax) if you invest in RRSP? How much will you have in 20 years if you invest in the taxable account? Which is better? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts