Question: Please show and explain 9. You need $10'000 for 2 years and you go to your bank asking for a loan. The loan officer gives

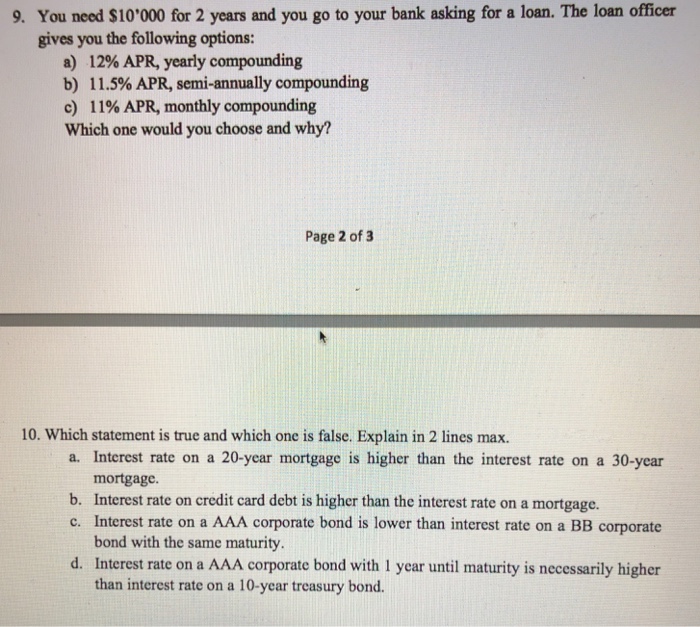

9. You need $10'000 for 2 years and you go to your bank asking for a loan. The loan officer gives you the following options: a) 12% APR, yearly compounding b) 11.5% APR, semi-annually compounding c) 1 1% APR, monthly compounding Which one would you choose and why? Page 2 of 3 10. Which statement is true and which one is false. Explain in 2 lines max. a. Interest rate on a 20-year mortgage is higher than the interest rate on a 30-year mortgage. b. Interest rate on credit card debt is higher than the interest rate on a mortgage. c. Interest rate on a AAA corporate bond is lower than interest rate on a BB corporate bond with the same maturity. d. Interest rate on a AAA corporate bond with 1 year until maturity is necessarily higher than interest rate on a 10-year treasury bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts