Question: Please show and explain all work & thank you!!! 6 You are considering investing in a company that cultivates abalone for sale to local restaurants.

Please show and explain all work & thank you!!!

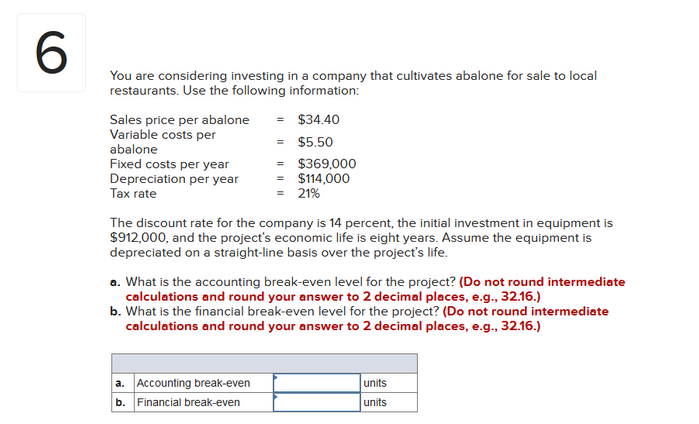

6 You are considering investing in a company that cultivates abalone for sale to local restaurants. Use the following information: Sales price per abalone = $34.40 Variable costs per abalone = $5.50 Fixed costs per year = $369,000 Depreciation per year = $114,000 Tax rate = 21% The discount rate for the company is 14 percent, the initial investment in equipment is $912,000, and the project's economic life is eight years. Assume the equipment is depreciated on a straight-line basis over the project's life. a. What is the accounting break-even level for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the financial break-even level for the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) units a. Accounting break-even b. Financial break-even units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts