Question: Please show and explain all working out. Thank you :) WORKSHOP TASKS: Evaluating Project Viability Using Net Present Value (NPV) Analysis Your firm is considering

Please show and explain all working out. Thank you :)

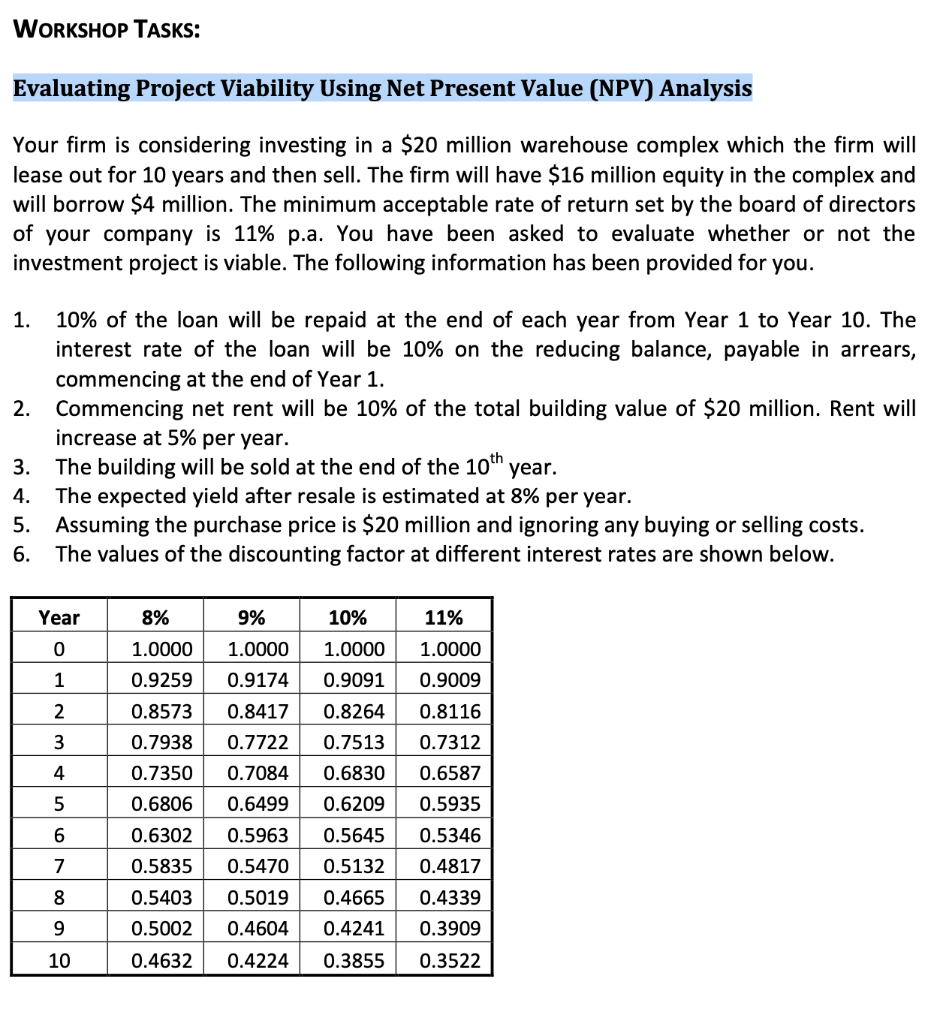

WORKSHOP TASKS: Evaluating Project Viability Using Net Present Value (NPV) Analysis Your firm is considering investing in a $20 million warehouse complex which the firm will lease out for 10 years and then sell. The firm will have $16 million equity in the complex and will borrow $4 million. The minimum acceptable rate of return set by the board of directors of your company is 11% p.a. You have been asked to evaluate whether or not the investment project is viable. The following information has been provided for you. 1. 10% of the loan will be repaid at the end of each year from Year 1 to Year 10. The interest rate of the loan will be 10% on the reducing balance, payable in arrears, commencing at the end of Year 1. 2. Commencing net rent will be 10% of the total building value of $20 million. Rent will increase at 5% per year. 3. The building will be sold at the end of the 10th year. 4. The expected yield after resale is estimated at 8% per year. 5. Assuming the purchase price is $20 million and ignoring any buying or selling costs. 6. The values of the discounting factor at different interest rates are shown below. Year 8% 9% 10% 11% 0 1.0000 1.0000 1.0000 1.0000 1 0.9259 0.9174 0.9091 0.9009 2 0.8573 0.8417 0.8264 0.8116 3 0.7938 0.7722 0.7513 0.7312 4 0.7350 0.7084 0.6830 0.6587 5 0.6806 0.6499 0.6209 0.5935 6 0.6302 0.5963 0.5645 0.5346 7 0.5835 0.5470 0.5132 0.4817 8 0.5403 0.5019 0.4665 0.4339 9 0.5002 0.4604 0.4241 0.3909 10 0.4632 0.4224 0.3855 0.3522 WORKSHOP TASKS: Evaluating Project Viability Using Net Present Value (NPV) Analysis Your firm is considering investing in a $20 million warehouse complex which the firm will lease out for 10 years and then sell. The firm will have $16 million equity in the complex and will borrow $4 million. The minimum acceptable rate of return set by the board of directors of your company is 11% p.a. You have been asked to evaluate whether or not the investment project is viable. The following information has been provided for you. 1. 10% of the loan will be repaid at the end of each year from Year 1 to Year 10. The interest rate of the loan will be 10% on the reducing balance, payable in arrears, commencing at the end of Year 1. 2. Commencing net rent will be 10% of the total building value of $20 million. Rent will increase at 5% per year. 3. The building will be sold at the end of the 10th year. 4. The expected yield after resale is estimated at 8% per year. 5. Assuming the purchase price is $20 million and ignoring any buying or selling costs. 6. The values of the discounting factor at different interest rates are shown below. Year 8% 9% 10% 11% 0 1.0000 1.0000 1.0000 1.0000 1 0.9259 0.9174 0.9091 0.9009 2 0.8573 0.8417 0.8264 0.8116 3 0.7938 0.7722 0.7513 0.7312 4 0.7350 0.7084 0.6830 0.6587 5 0.6806 0.6499 0.6209 0.5935 6 0.6302 0.5963 0.5645 0.5346 7 0.5835 0.5470 0.5132 0.4817 8 0.5403 0.5019 0.4665 0.4339 9 0.5002 0.4604 0.4241 0.3909 10 0.4632 0.4224 0.3855 0.3522

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts