Question: Please show and explain. it will be helpful to me. thank you! Complete the following two questions prior to the in-class meeting ld have Explain

Please show and explain. it will be helpful to me. thank you!

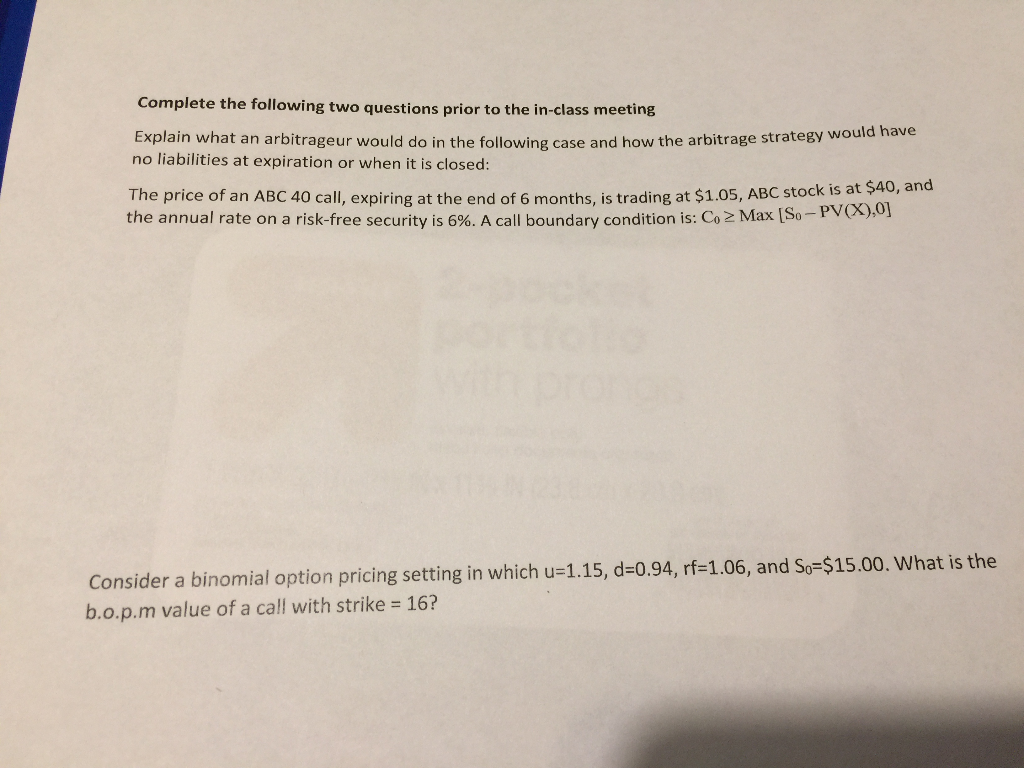

Complete the following two questions prior to the in-class meeting ld have Explain what an arbitrageur would do in the following case and how the arbitrage strategy wou no liabilities at expiration or when it is closed The price of an ABC 40 call, expiring at the end of 6 months, is trading at $1.05, ABC stock is at $40, and the annual rate on a risk-free security is 6%. A call boundary condition is: Co Max [So (X) ry condition is: Co Max [S-PVx,0 Consider a binomial option pricing setting in which u-1.15, d-0.94, rf-1.06, and So-$15.00. What is the b...m value of a call with strike-167 Complete the following two questions prior to the in-class meeting ld have Explain what an arbitrageur would do in the following case and how the arbitrage strategy wou no liabilities at expiration or when it is closed The price of an ABC 40 call, expiring at the end of 6 months, is trading at $1.05, ABC stock is at $40, and the annual rate on a risk-free security is 6%. A call boundary condition is: Co Max [So (X) ry condition is: Co Max [S-PVx,0 Consider a binomial option pricing setting in which u-1.15, d-0.94, rf-1.06, and So-$15.00. What is the b...m value of a call with strike-167

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts