Question: Please show and explain the steps if possible. ! Required information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of

![[The following information applies to the questions displayed below.] Aces Incorporated, a](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fb82b3c6d38_02766fb82b3615b9.jpg)

Please show and explain the steps if possible.

Please show and explain the steps if possible.

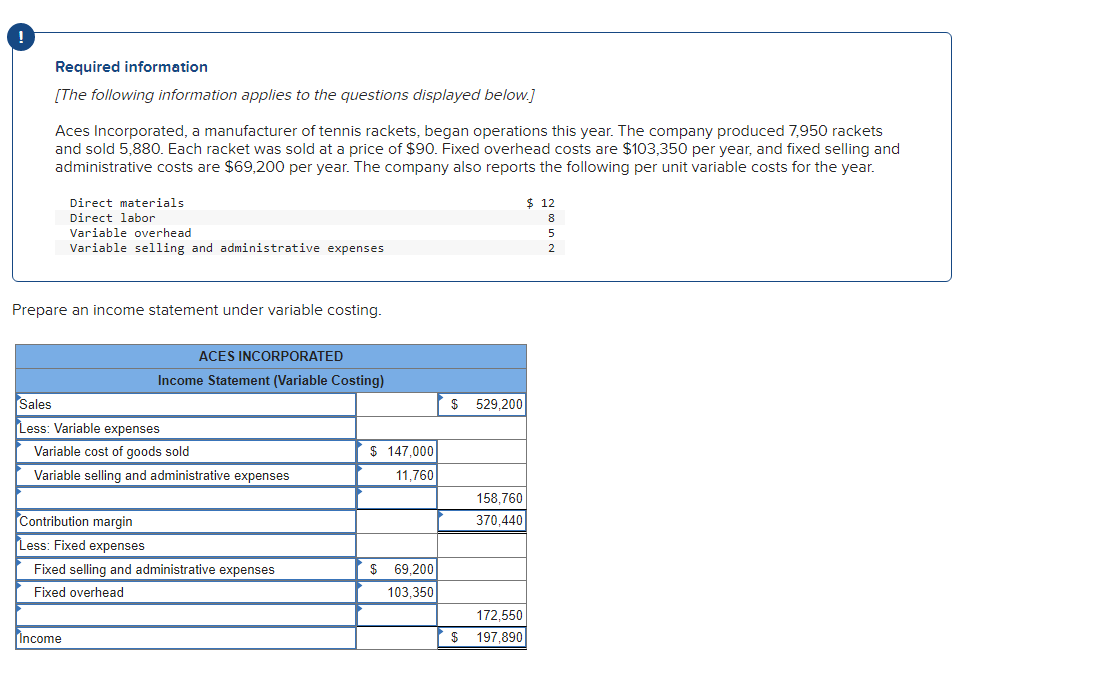

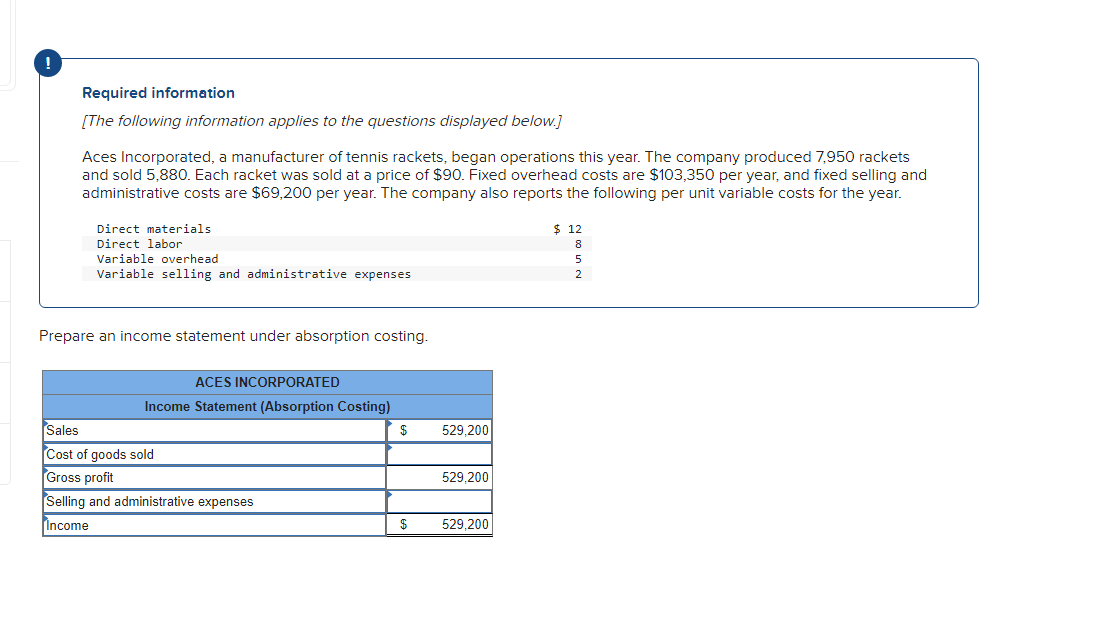

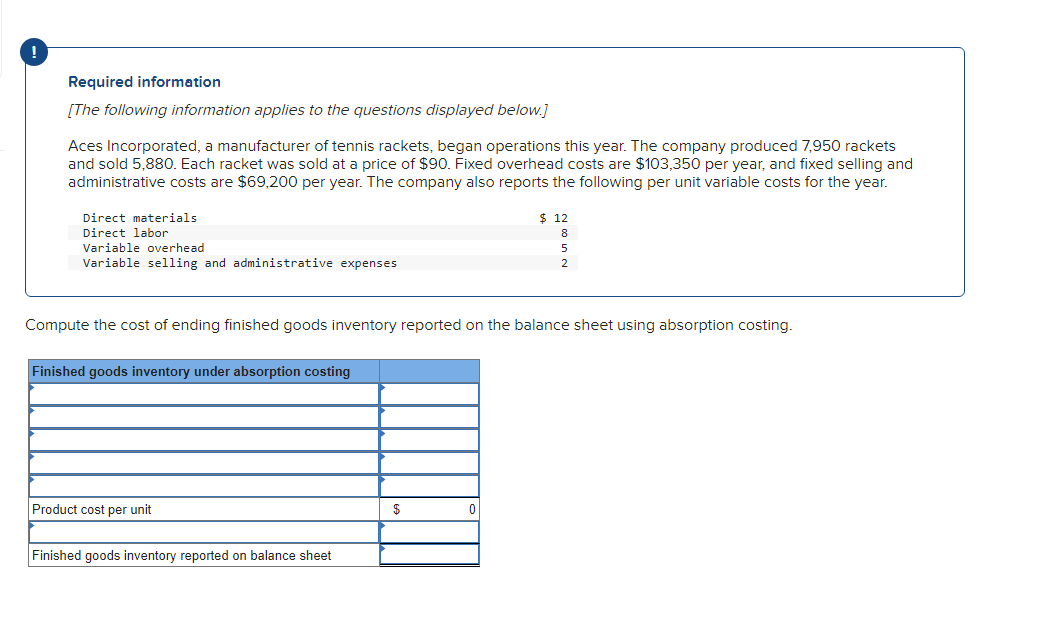

! Required information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,950 rackets and sold 5,880. Each racket was sold at a price of $90. Fixed overhead costs are $103,350 per year, and fixed selling and administrative costs are $69,200 per year. The company also reports the following per unit variable costs for the year. $ 12 8 Direct materials Direct labor Variable overhead Variable selling and administrative expenses Nuo Prepare an income statement under variable costing. $ 529,200 ACES INCORPORATED Income Statement (Variable Costing) Sales Less: Variable expenses Variable cost of goods sold $ 147,000 Variable selling and administrative expenses 11,760 158,760 370.440 Contribution margin Less: Fixed expenses Fixed selling and administrative expenses Fixed overhead $ 69.200 103,350 172,550 197,890 Income $ Required information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,950 rackets and sold 5,880. Each racket was sold at a price of $90. Fixed overhead costs are $103,350 per year, and fixed selling and administrative costs are $69,200 per year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses $ 12 8 5 2 Compute the cost of ending finished goods inventory reported on the balance sheet using variable costing. $ 12 Finished goods inventory under variable costing Direct materials Direct labor Variable overhead 8 5 Product cost per unit $ 25 Finished goods inventory reported on balance sheet $ 51,750 Required information [The following information applies to the questions displayed below.] Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,950 rackets and sold 5,880. Each racket was sold at a price of $90. Fixed overhead costs are $103,350 per year, and fixed selling and administrative costs are $69,200 per year. The company also reports the following per unit variable costs for the year. Direct materials Direct labor Variable overhead Variable selling and administrative expenses $ 12 8 5 Prepare an income statement under absorption costing. $ 529,200 ACES INCORPORATED Income Statement (Absorption Costing) Sales Cost of goods sold Gross profit Selling and administrative expenses 529,200 Income $ 529,200 Required information (The following information applies to the questions displayed below.) Aces Incorporated, a manufacturer of tennis rackets, began operations this year. The company produced 7,950 rackets and sold 5,880. Each racket was sold at a price of $90. Fixed overhead costs are $103,350 per year, and fixed selling and administrative costs are $69,200 per year. The company also reports the following per unit variable costs for the year. $ 12 Direct materials Direct labor Variable overhead Variable selling and administrative expenses 5 2 Compute the cost of ending finished goods inventory reported on the balance sheet using absorption costing. Finished goods inventory under absorption costing Product cost per unit $ 0 Finished goods inventory reported on balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts