Question: -- please show any calculator steps as well. Preferably without excel if possible as we won't get to use it on the upcoming exam and

-- please show any calculator steps as well. Preferably without excel if possible as we won't get to use it on the upcoming exam and I would like to know how to do this type of problem.

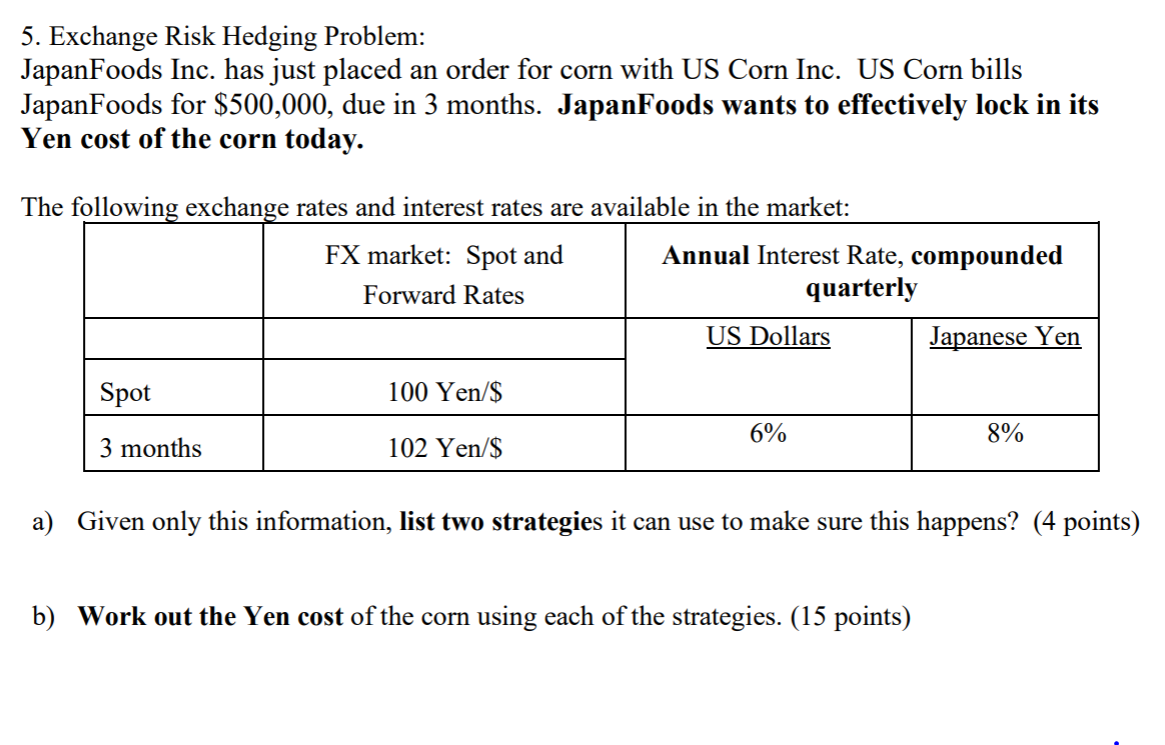

5. Exchange Risk Hedging Problem: JapanFoods Inc. has just placed an order for corn with US Corn Inc. US Corn bills JapanFoods for $500,000, due in 3 months. JapanFoods wants to effectively lock in its Yen cost of the corn today. The following exchange rates and interest rates are available in the market: FX market: Spot and Annual Interest Rate, compounded Forward Rates quarterly US Dollars Japanese Yen Spot 100 Yen/$ 3 months 8% 102 Yen/$ L6% a) Given only this information, list two strategies it can use to make sure this happens? (4 points) b) Work out the Yen cost of the corn using each of the strategies. (15 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts