Question: Please show any Financial calculator inputs. QUESTION 13 . Sequential Pay security This question is based on the following CMO -100 residential loans, average starting

Please show any Financial calculator inputs.

Please show any Financial calculator inputs.

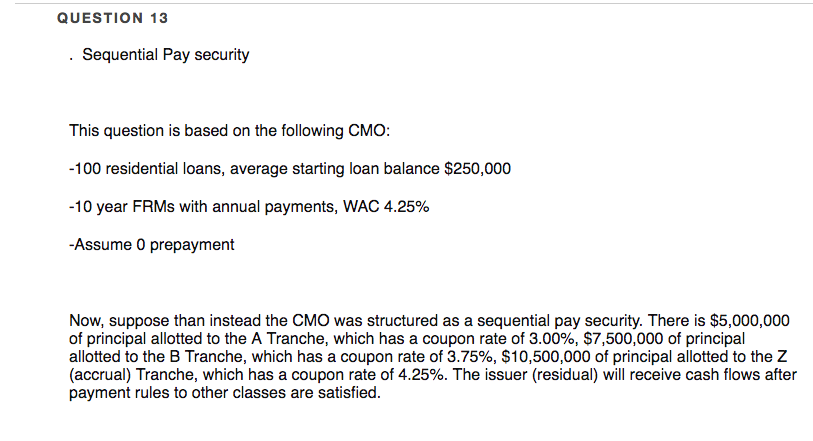

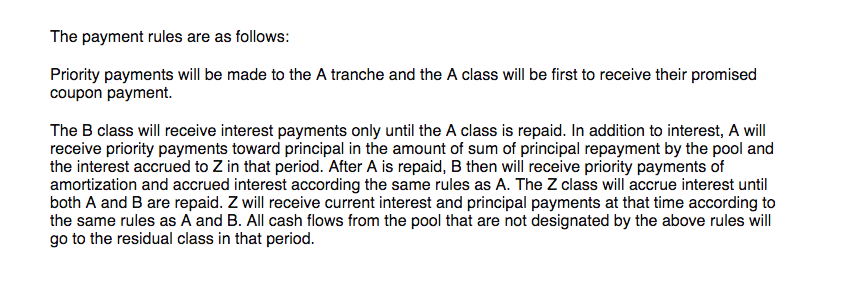

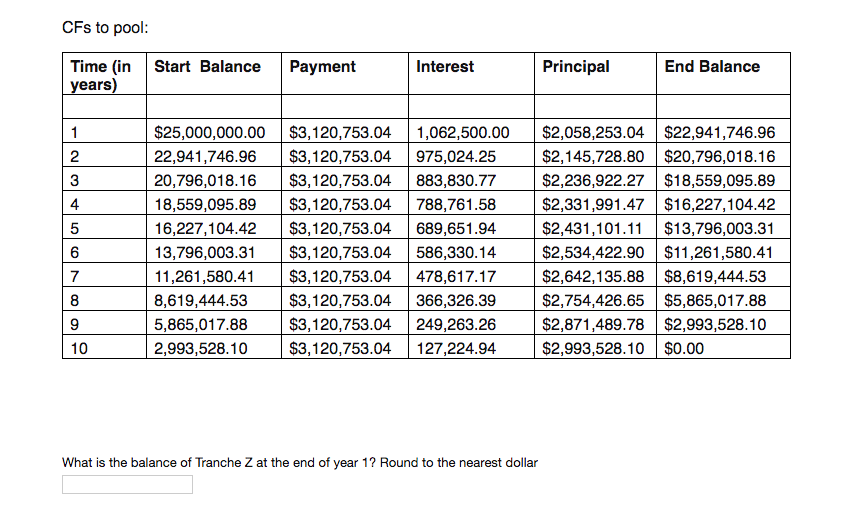

QUESTION 13 . Sequential Pay security This question is based on the following CMO -100 residential loans, average starting loan balance $250,000 -10 year FRMs with annual payments, WAC 4.25% -Assume 0 prepayment Now, suppose than instead the CMO was structured as a sequential pay security. There is $5,000,000 of principal allotted to the A Tranche, which has a coupon rate of 3.00%, $7,500,000 of principal allotted to the B Tranche, which has a coupon rate of 3.75%, $10,500,000 of principal allotted to the Z (accrual) Tranche, which has a coupon rate of 4.25%. The issuer (residual) will receive cash flows after payment rules to other classes are satisfied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts