Question: Please show below calculations in Excel: Q3 (B-S Option Pricing) ABC stock is being traded at $115 today. Consider European put and call options with

Please show below calculations in Excel:

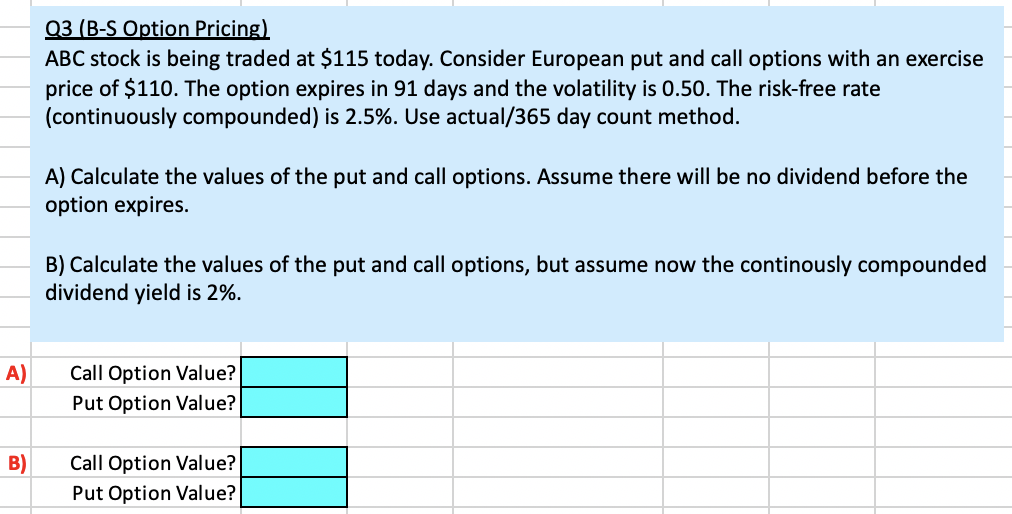

Q3 (B-S Option Pricing) ABC stock is being traded at $115 today. Consider European put and call options with an exercise price of $110. The option expires in 91 days and the volatility is 0.50. The risk-free rate (continuously compounded) is 2.5%. Use actual/365 day count method. A) Calculate the values of the put and call options. Assume there will be no dividend before the option expires. B) Calculate the values of the put and call options, but assume now the continously compounded dividend yield is 2%. A) Call Option Value? Put Option Value? B) Call Option Value? Put Option Value

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock