Question: ***PLEASE SHOW BREAK DOWN OF WORK STEP BY STEP FOR EACH QUESTION. THANK YOU!!*** (4. You are evaluating a growing perpetuity investment from a large

***PLEASE SHOW BREAK DOWN OF WORK STEP BY STEP FOR EACH QUESTION. THANK YOU!!***

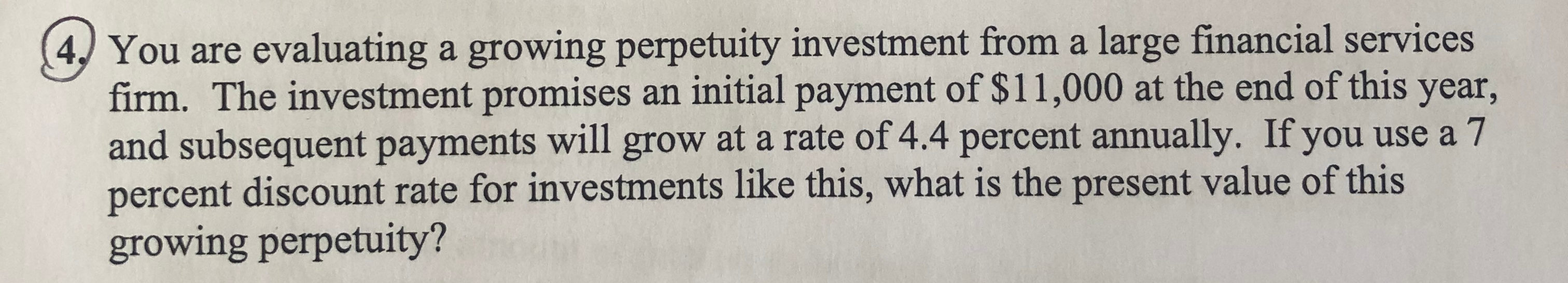

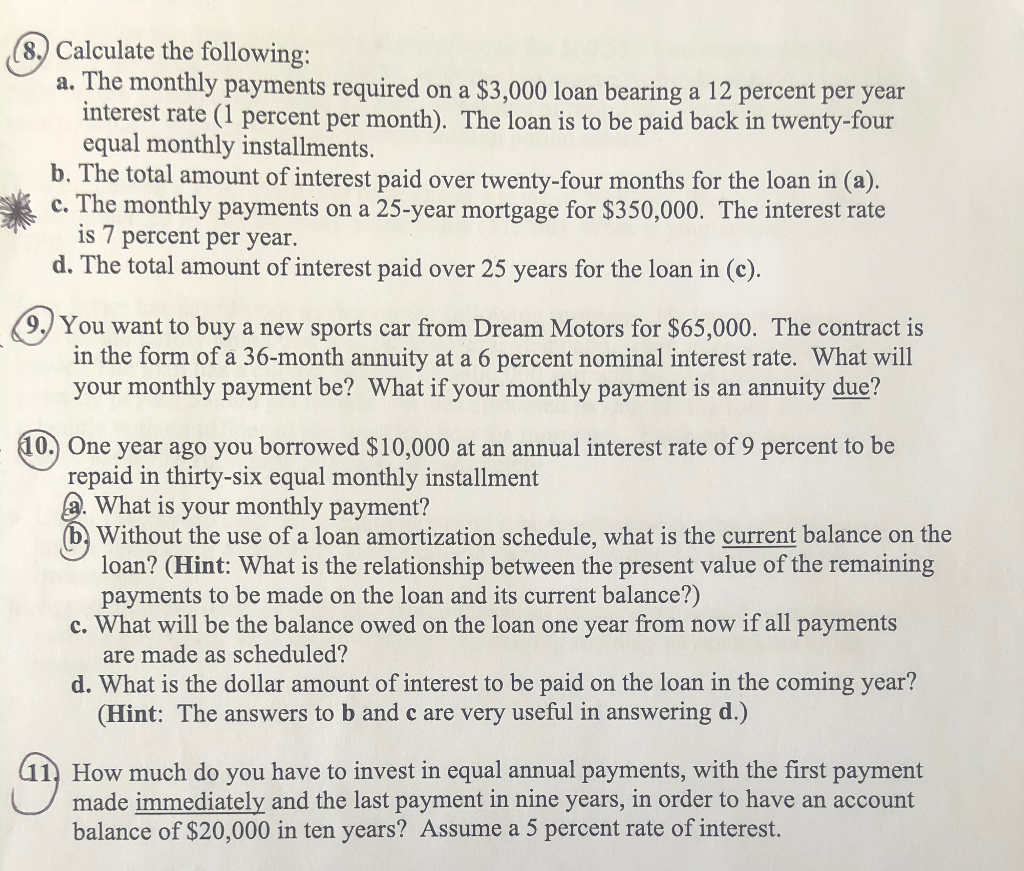

(4. You are evaluating a growing perpetuity investment from a large financial services firm. The investment promises an initial payment of $11,000 at the end of this year, and subsequent payments will grow at a rate of 4.4 percent annually. If you use a 7 percent discount rate for investments like this, what is the present value of this growing perpetuity? (8. Calculate the following: a. The monthly payments required on a $3,000 loan bearing a 12 percent per year interest rate (1 percent per month). The loan is to be paid back in twenty-four equal monthly installments. b. The total amount of interest paid over twenty-four months for the loan in (a). c. The monthly payments on a 25-year mortgage for $350,000. The interest rate is 7 percent per year. d. The total amount of interest paid over 25 years for the loan in (c). (9.) You want to buy a new sports car from Dream Motors for $65,000. The contract is in the form of a 36-month annuity at a 6 percent nominal interest rate. What will your monthly payment be? What if your monthly payment is an annuity due? ago you borrowed $10.000 at an annual interest rate of 9 percent to be repaid in thirty-six equal monthly installment a. What is your monthly payment? Without the use of a loan amortization schedule, what is the current balance on the loan? (Hint: What is the relationship between the present value of the remaining payments to be made on the loan and its current balance?) c. What will be the balance owed on the loan one year from now if all payments are made as scheduled? d. What is the dollar amount of interest to be paid on the loan in the coming year? (Hint: The answers to b and c are very useful in answering d.) How much do you have to invest in equal annual payments, with the first payment made immediately and the last payment in nine years, in order to have an account balance of $20,000 in ten years? Assume a 5 percent rate of interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts