Question: Please show calculation 2. Consider two coupon bonds, both issued by the same corporation, both having a face value of $1,000, both having a coupon

Please show calculation

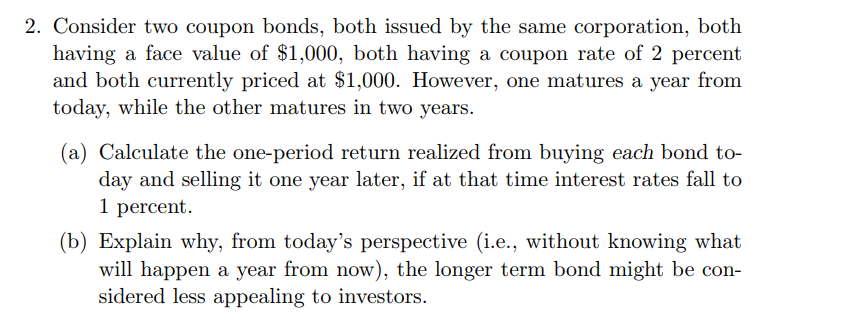

2. Consider two coupon bonds, both issued by the same corporation, both having a face value of $1,000, both having a coupon rate of 2 percent and both currently priced at $1,000. However, one matures a year from today, while the other matures in two years. (a) Calculate the one-period return realized from buying each bond to- day and selling it one year later, if at that time interest rates fall to 1 percent. (b) Explain why, from today's perspective (i.e., without knowing what will happen a year from now), the longer term bond might be con- sidered less appealing to investors. 2. Consider two coupon bonds, both issued by the same corporation, both having a face value of $1,000, both having a coupon rate of 2 percent and both currently priced at $1,000. However, one matures a year from today, while the other matures in two years. (a) Calculate the one-period return realized from buying each bond to- day and selling it one year later, if at that time interest rates fall to 1 percent. (b) Explain why, from today's perspective (i.e., without knowing what will happen a year from now), the longer term bond might be con- sidered less appealing to investors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts