Question: please show calculation method not excel 4. (34 points) (a). Suppose you know that a company's stock currently sells for $56 per share and the

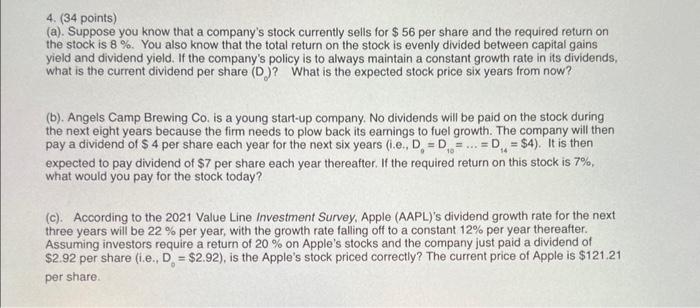

4. (34 points) (a). Suppose you know that a company's stock currently sells for $56 per share and the required return on the stock is 8%. You also know that the total return on the stock is evenly divided between capital gains yield and dividend yield. If the company's policy is to always maintain a constant growth rate in its dividends, what is the current dividend per share (D)? What is the expected stock price six years from now? (b). Angels Camp Brewing Co. is a young start-up company. No dividends will be paid on the stock during the next eight years because the firm needs to plow back its earnings to fuel growth. The company will then pay a dividend of $4 per share each year for the next six years (i.e,D0=D10==D14=$4). It is then expected to pay dividend of $7 per share each year thereafter. If the required return on this stock is 7%, what would you pay for the stock today? (c). According to the 2021 Value Line Investment Survey, Apple (AAPL)'s dividend growth rate for the next three years will be 22% per year, with the growth rate falling off to a constant 12% per year thereafter. Assuming investors require a return of 20% on Apple's stocks and the company just paid a dividend of $2.92 per share (i.e., D0=$2.92 ), is the Apple's stock priced correctly? The current price of Apple is $121.21 per share. 4. (34 points) (a). Suppose you know that a company's stock currently sells for $56 per share and the required return on the stock is 8%. You also know that the total return on the stock is evenly divided between capital gains yield and dividend yield. If the company's policy is to always maintain a constant growth rate in its dividends, What is the current dividend per share (D)? What is the expected stock price six years from now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts