Question: Please show calculation workings for each question. Thank you. QUESTION 3 DURATION (in years) 620 1 ASSETS Cash 3-year commercial loan 6- year Treasury bond

Please show calculation workings for each question. Thank you.

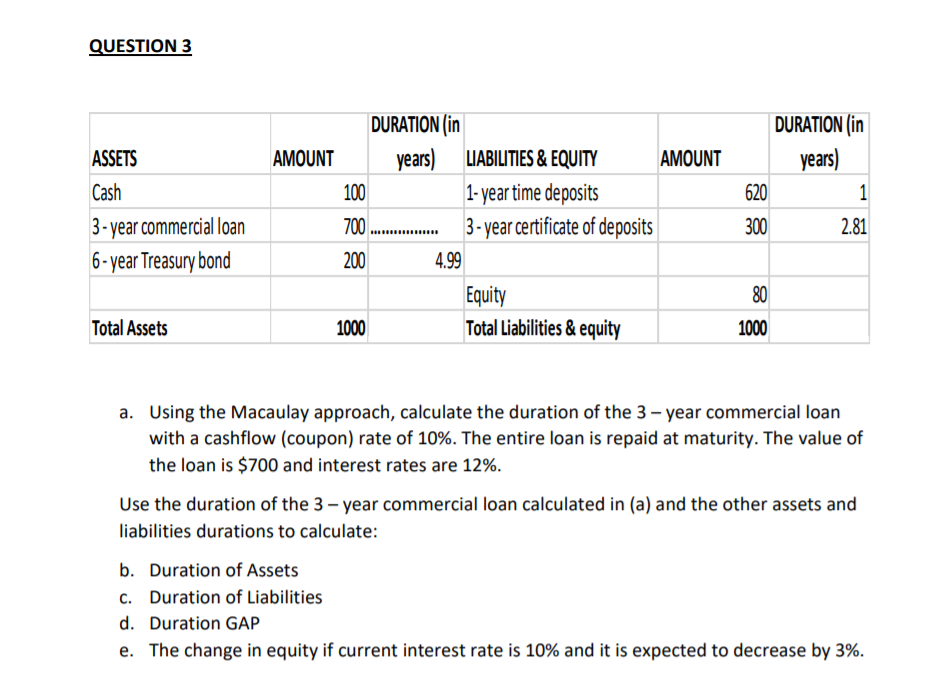

QUESTION 3 DURATION (in years) 620 1 ASSETS Cash 3-year commercial loan 6- year Treasury bond DURATION (in AMOUNT years) LIABILITIES & EQUITY AMOUNT 100 1- year time deposits 700 3- year certificate of deposits 200 4.99 Equity 1000 Total Liabilities & equity 300 2.81 80 Total Assets 1000 a. Using the Macaulay approach, calculate the duration of the 3 year commercial loan with a cashflow (coupon) rate of 10%. The entire loan is repaid at maturity. The value of the loan is $700 and interest rates are 12%. Use the duration of the 3-year commercial loan calculated in (a) and the other assets and liabilities durations to calculate: b. Duration of Assets C. Duration of Liabilities d. Duration GAP e. The change in equity if current interest rate is 10% and it is expected to decrease by 3%. QUESTION 3 DURATION (in years) 620 1 ASSETS Cash 3-year commercial loan 6- year Treasury bond DURATION (in AMOUNT years) LIABILITIES & EQUITY AMOUNT 100 1- year time deposits 700 3- year certificate of deposits 200 4.99 Equity 1000 Total Liabilities & equity 300 2.81 80 Total Assets 1000 a. Using the Macaulay approach, calculate the duration of the 3 year commercial loan with a cashflow (coupon) rate of 10%. The entire loan is repaid at maturity. The value of the loan is $700 and interest rates are 12%. Use the duration of the 3-year commercial loan calculated in (a) and the other assets and liabilities durations to calculate: b. Duration of Assets C. Duration of Liabilities d. Duration GAP e. The change in equity if current interest rate is 10% and it is expected to decrease by 3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts