Question: please show calculations (6 points) Show your work and, where appropriate, include timelines and equations using actuarial notation in answering following questions: a) A perpetuity

please show calculations

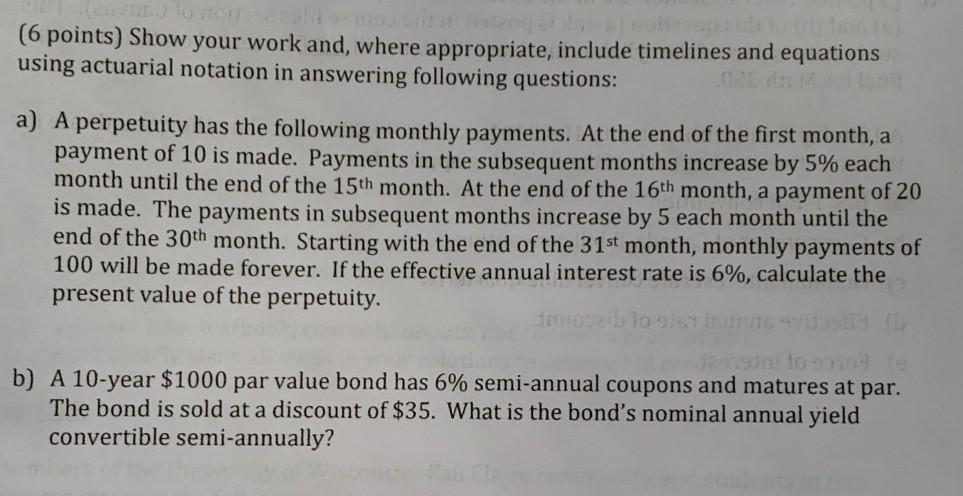

(6 points) Show your work and, where appropriate, include timelines and equations using actuarial notation in answering following questions: a) A perpetuity has the following monthly payments. At the end of the first month, a payment of 10 is made. Payments in the subsequent months increase by 5% each month until the end of the 15th month. At the end of the 16th month, a payment of 20 is made. The payments in subsequent months increase by 5 each month until the end of the 30th month. Starting with the end of the 31st month, monthly payments of 100 will be made forever. If the effective annual interest rate is 6%, calculate the present value of the perpetuity. b) A 10-year $1000 par value bond has 6% semi-annual coupons and matures at par. The bond is sold at a discount of $35. What is the bond's nominal annual yield convertible semi-annually? (6 points) Show your work and, where appropriate, include timelines and equations using actuarial notation in answering following questions: a) A perpetuity has the following monthly payments. At the end of the first month, a payment of 10 is made. Payments in the subsequent months increase by 5% each month until the end of the 15th month. At the end of the 16th month, a payment of 20 is made. The payments in subsequent months increase by 5 each month until the end of the 30th month. Starting with the end of the 31st month, monthly payments of 100 will be made forever. If the effective annual interest rate is 6%, calculate the present value of the perpetuity. b) A 10-year $1000 par value bond has 6% semi-annual coupons and matures at par. The bond is sold at a discount of $35. What is the bond's nominal annual yield convertible semi-annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts