Question: Please show calculations for a regular calculator and do not use excel or functions. A stock is expected to pay a dividend of $0.50 at

Please show calculations for a regular calculator and do not use excel or functions.

Please show calculations for a regular calculator and do not use excel or functions.

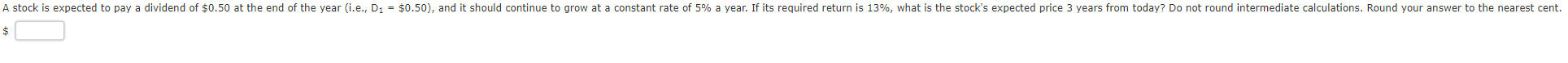

A stock is expected to pay a dividend of $0.50 at the end of the year (i.e., D1 = $0.50), and it should continue to grow at a constant rate of 5% a year. If its required return is 13%, what is the stock's expected price 3 years from today? Do not round intermediate calculations. Round your answer to the nearest cent. $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts