Question: Please show calculations in answer. Chapter 14 BAM J. Clark Inc. (JCI), a manufacturer and distributer of sports equipment, has grown until it has become

Please show calculations in answer.

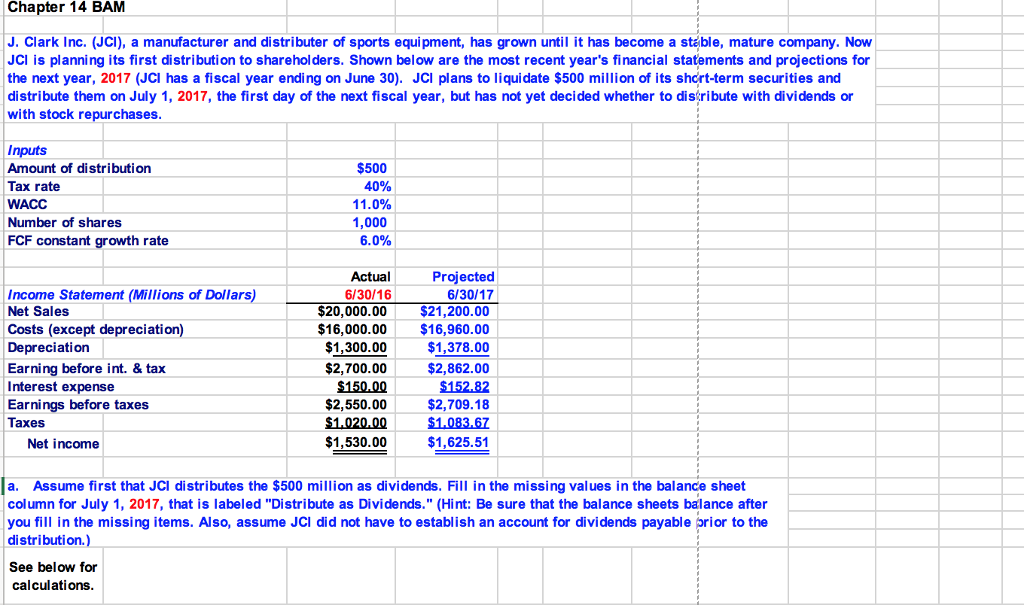

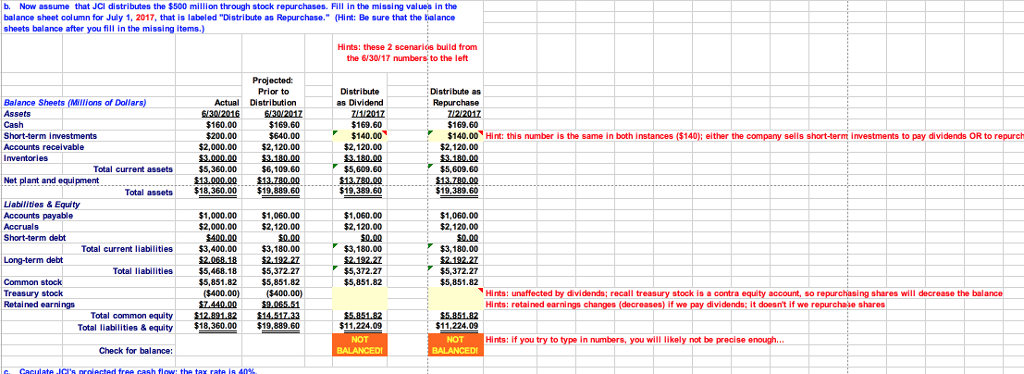

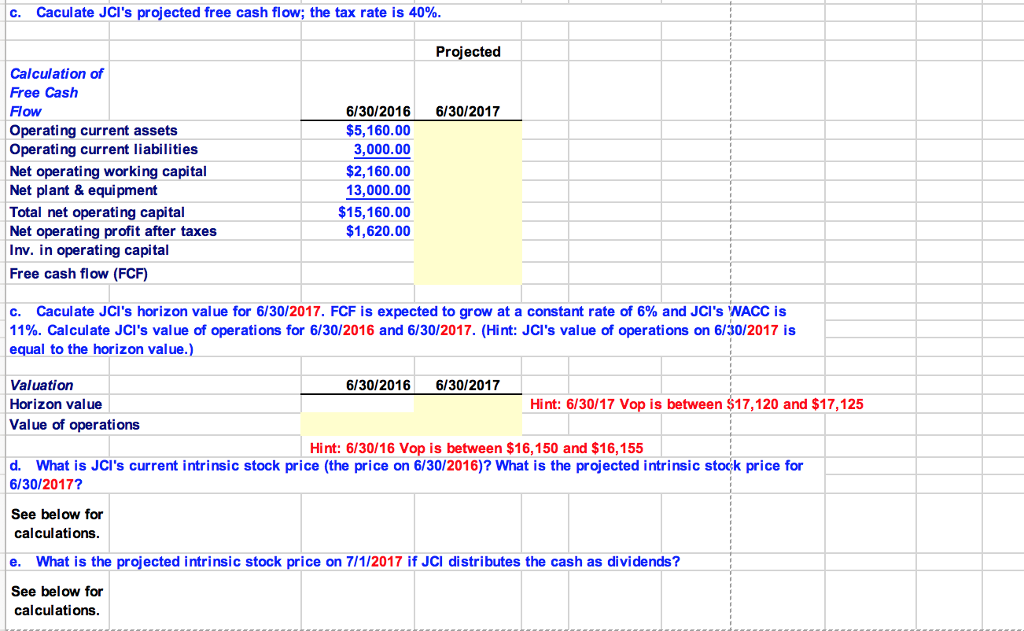

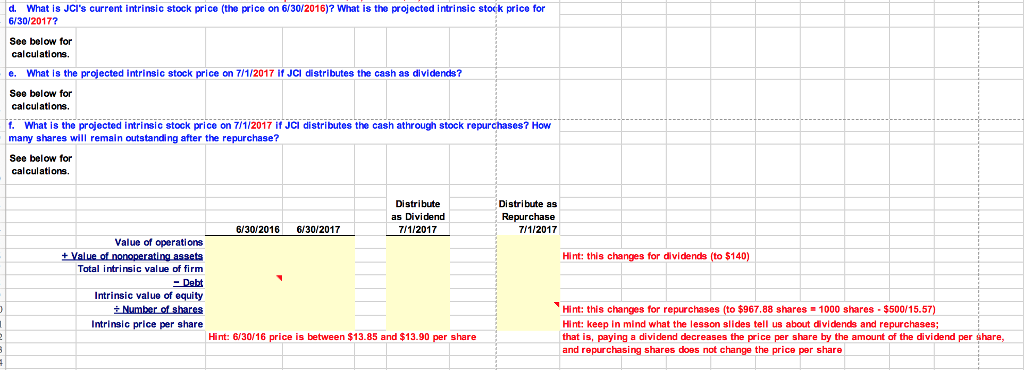

Chapter 14 BAM J. Clark Inc. (JCI), a manufacturer and distributer of sports equipment, has grown until it has become a stable, mature company. Now JCl is planning its first distribution to shareholders. Shown below are the most recent year's financial statements and projections for the next year, 2017 (JCI has a fiscal year ending on June 30). JCI plans to liquidate $500 million of its short-term securities and distribute them on July 1, 2017, the first day of the next fiscal year, but has not yet decided whether to distribute with dividends or with stock repurchases Inputs Amount of distribution Tax rate WACC Number of shares FCF constant growth rate $500 40% 11.0% 1,000 6.0% Projected 6/30/17 $20,000.00 $21,200.00 $16,000.00$16,960.00 $1,378.00 $2,862.00 $152.82 $2,709.18 $1.083.67 $1,625.5'1 Actual 6/30/16 Income Statement (Millions of Dollars) Net Sales Costs (except depreciation) Depreciation Earning before int. &tax Interest expense Earnings before taxes Taxes $1,300.00 $2,700.00 $150.00 $2,550.00 Net income $1,530.00 a. Assume first that JCI distributes the $500 million as dividends. Fill in the missing values in the balance sheet column for July 1, 2017, that is labeled "Distribute as Dividends." (Hint: Be sure that the balance sheets balance after you fill in the missing items. Also, assume JCI did not have to establish an account for dividends payable brior to the distribution.) See below for calculations Chapter 14 BAM J. Clark Inc. (JCI), a manufacturer and distributer of sports equipment, has grown until it has become a stable, mature company. Now JCl is planning its first distribution to shareholders. Shown below are the most recent year's financial statements and projections for the next year, 2017 (JCI has a fiscal year ending on June 30). JCI plans to liquidate $500 million of its short-term securities and distribute them on July 1, 2017, the first day of the next fiscal year, but has not yet decided whether to distribute with dividends or with stock repurchases Inputs Amount of distribution Tax rate WACC Number of shares FCF constant growth rate $500 40% 11.0% 1,000 6.0% Projected 6/30/17 $20,000.00 $21,200.00 $16,000.00$16,960.00 $1,378.00 $2,862.00 $152.82 $2,709.18 $1.083.67 $1,625.5'1 Actual 6/30/16 Income Statement (Millions of Dollars) Net Sales Costs (except depreciation) Depreciation Earning before int. &tax Interest expense Earnings before taxes Taxes $1,300.00 $2,700.00 $150.00 $2,550.00 Net income $1,530.00 a. Assume first that JCI distributes the $500 million as dividends. Fill in the missing values in the balance sheet column for July 1, 2017, that is labeled "Distribute as Dividends." (Hint: Be sure that the balance sheets balance after you fill in the missing items. Also, assume JCI did not have to establish an account for dividends payable brior to the distribution.) See below for calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts