Question: Please show calculations Net Present Value Method-Annuity Briggs Excavation Company is planning an investment of $419,200 for a bulldozer. The bulldozer is expected to operate

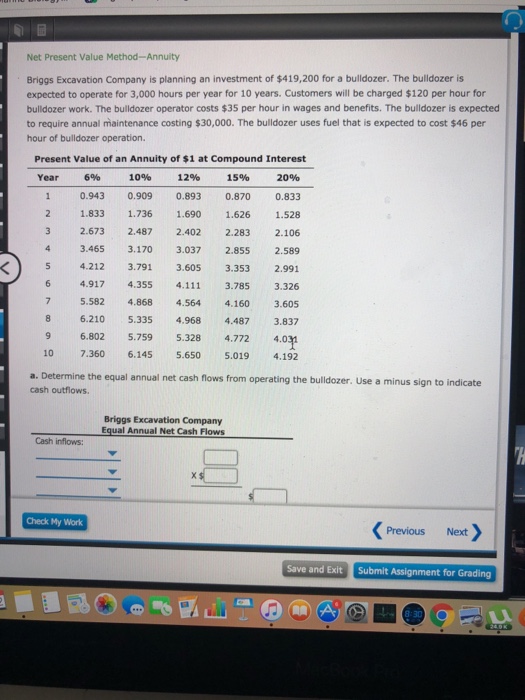

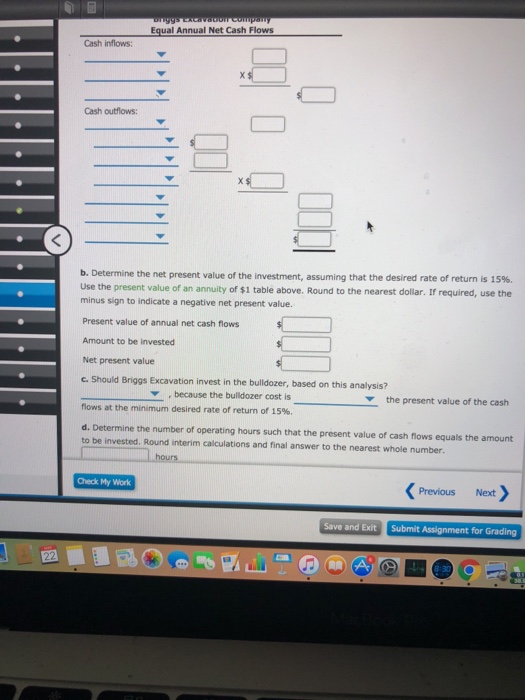

Net Present Value Method-Annuity Briggs Excavation Company is planning an investment of $419,200 for a bulldozer. The bulldozer is expected to operate for 3,000 hours per year for 10 years. Customers will be charged $120 per hour for bulldozer work. The bulldozer operator costs $35 per hour in wages and benefits. The bulldozer is expected to require annual maintenance costing $30,000. The bulldozer uses fuel that is expected to cost $46 per hour of bulldozer operation. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 10.943 0.909 0.893 0.870 0.833 2 1.833 1,736 1,690 1.626 1,528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.0 10 7.360 6.145 5.650 5.019 4.192 a. Determine the equal annual net cash flows from operating the bulldozer. Use a minus sign to indicate cash outflows. Briggs Excavation Company Equal Annual Net Cash Flows Cash inflows: Check My Work Previous Next Save and Exit Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts