Question: please show calculations not in excel please Problem 1 (17 pts) Jake and Jhenna are considering buying 200 shares of stock ABC each. ABC stock

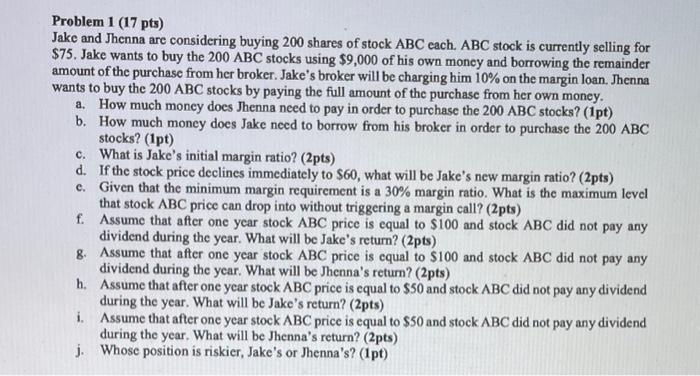

Problem 1 (17 pts) Jake and Jhenna are considering buying 200 shares of stock ABC each. ABC stock is currently selling for $75. Jake wants to buy the 200ABC stocks using $9,000 of his own money and borrowing the remainder amount of the purchase from her broker. Jake's broker will be charging him 10% on the margin loan. Jhenna wants to buy the 200ABC stocks by paying the full amount of the purchase from her own money. a. How much money does Jhenna need to pay in order to purchase the 200ABC stocks? (1pt) b. How much money does Jake need to borrow from his broker in order to purchase the 200ABC stocks? (1pt) c. What is Jake's initial margin ratio? (2pts) d. If the stock price declines immediately to $60, what will be Jake's new margin ratio? (2pts) e. Given that the minimum margin requirement is a 30% margin ratio. What is the maximum level that stock ABC price can drop into without triggering a margin call? (2pts) f. Assume that after one year stock ABC price is equal to $100 and stock ABC did not pay any dividend during the year. What will be Jake's return? (2pts) 8. Assume that after one year stock ABC price is equal to $100 and stock ABC did not pay any dividend during the year. What will be Jhenna's return? (2pts) h. Assume that after one year stock ABC price is equal to $50 and stock ABC did not pay any dividend during the year. What will be Jake's return? (2pts) i. Assume that after one year stock ABC price is equal to $50 and stock ABC did not pay any dividend during the year. What will be Jhenna's return? (2pts) j. Whose position is riskier, Jake's or Jhenna's? (1pt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts