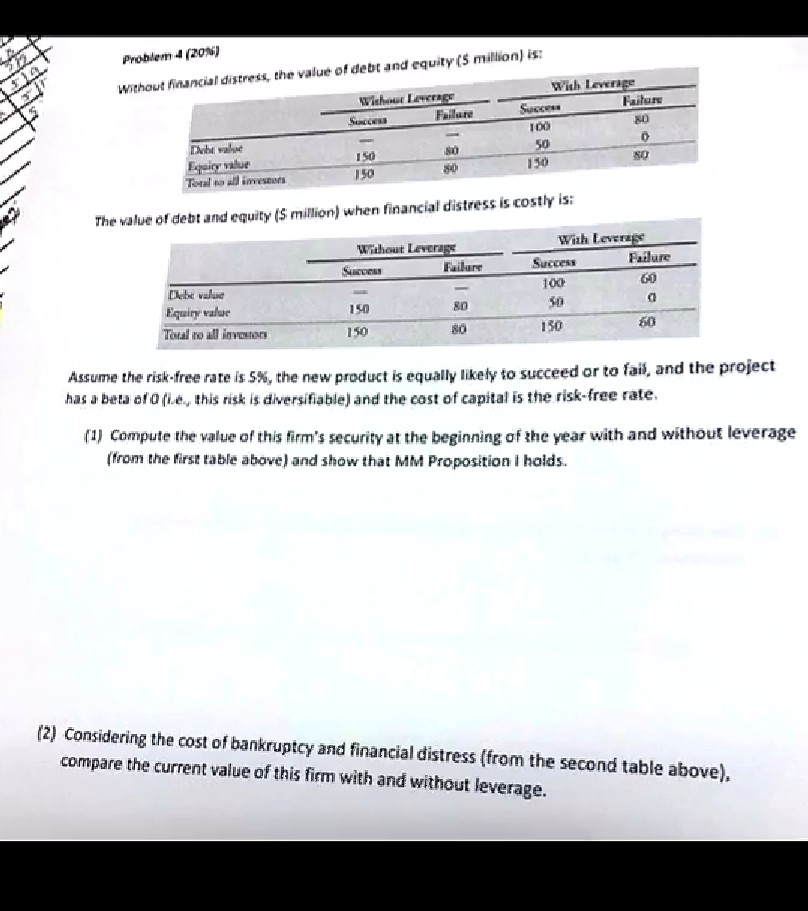

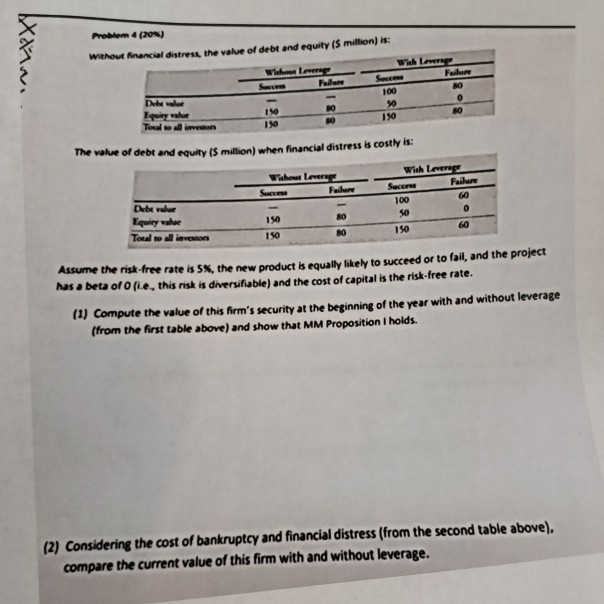

Question: please show calculations. Problem 4/20N) without financial distress, the value of debrand equity (5 million) is: With Large Faila Wicho Lecce SUCCESS Failure Success 100

please show calculations.

Problem 4/20N) without financial distress, the value of debrand equity (5 million) is: With Large Faila Wicho Lecce SUCCESS Failure Success 100 50 50 Dat wala Equity valur Toate all investors ISO 150 150 The value of debt and equity (5 million) when financial distress is costly is: Without Loverage Fuiker With Leverage Success Failure 100 30 150 Debt value Equing value Total to all investors 150 80 60 1:50 80 Assume the risk-free rate is 5%, the new product is equally likely to succeed or to fail, and the project has a beta of this risk is diversifiable) and the cost of capital is the risk-free rate (4) Compute the value of this firm's security at the beginning of the year with and without leverage (from the first table above) and show that MM Proposition I holds. (2) Considering the cost of bankruptcy and financial distress (from the second table above). compare the current value of this firm with and without leverage. Mw Pro (20) Without Financial distress the value of debt and equity (5 million) is: Wish Le Wahl 100 DN Lewe Town 130 The value of debt and equity is million) when financial distress is costly is: Without Lovers Fallere Wish Lovers Failure Sucens S 100 Det value Equity value Tel iavoston 150 Assume the risk-free rate is 5%, the new product is equally likely to succeed or to fail, and the project has a beta of Ofie, this risk is diversifiable) and the cost of capital is the risk-free rate. (1) Compute the value of this firm's security at the beginning of the year with and without leverage (from the first table above) and show that MM Proposition I holds. (2) Considering the cost of bankruptcy and financial distress (from the second table above), compare the current value of this firm with and without leverage. Problem 4/20N) without financial distress, the value of debrand equity (5 million) is: With Large Faila Wicho Lecce SUCCESS Failure Success 100 50 50 Dat wala Equity valur Toate all investors ISO 150 150 The value of debt and equity (5 million) when financial distress is costly is: Without Loverage Fuiker With Leverage Success Failure 100 30 150 Debt value Equing value Total to all investors 150 80 60 1:50 80 Assume the risk-free rate is 5%, the new product is equally likely to succeed or to fail, and the project has a beta of this risk is diversifiable) and the cost of capital is the risk-free rate (4) Compute the value of this firm's security at the beginning of the year with and without leverage (from the first table above) and show that MM Proposition I holds. (2) Considering the cost of bankruptcy and financial distress (from the second table above). compare the current value of this firm with and without leverage. Mw Pro (20) Without Financial distress the value of debt and equity (5 million) is: Wish Le Wahl 100 DN Lewe Town 130 The value of debt and equity is million) when financial distress is costly is: Without Lovers Fallere Wish Lovers Failure Sucens S 100 Det value Equity value Tel iavoston 150 Assume the risk-free rate is 5%, the new product is equally likely to succeed or to fail, and the project has a beta of Ofie, this risk is diversifiable) and the cost of capital is the risk-free rate. (1) Compute the value of this firm's security at the beginning of the year with and without leverage (from the first table above) and show that MM Proposition I holds. (2) Considering the cost of bankruptcy and financial distress (from the second table above), compare the current value of this firm with and without leverage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts