Question: please show caluclations under each entry and enter the dates 2020 Sept 17 Purchased merchandise inventory in the amount of $18,000, plus HST @ 13%,

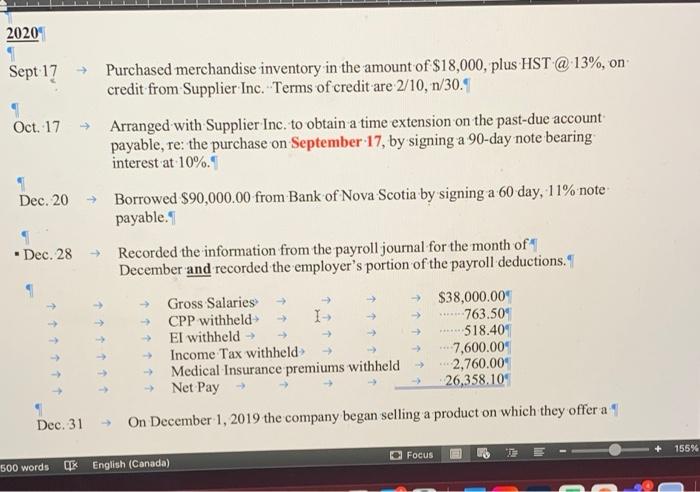

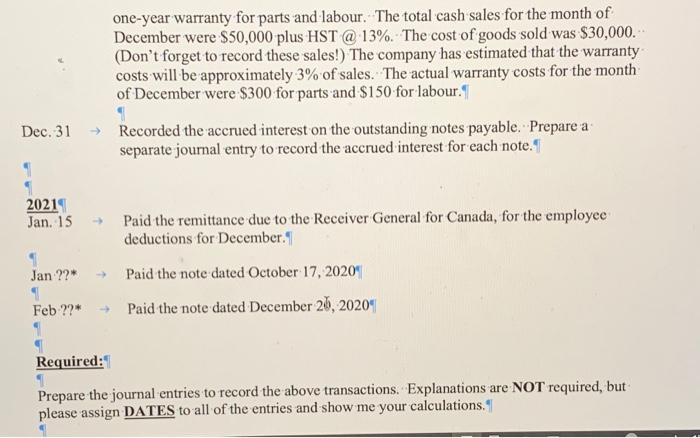

2020 Sept 17 Purchased merchandise inventory in the amount of $18,000, plus HST @ 13%, on credit from Supplier Inc. Terms of credit are 2/10, n/30.9 Oct. 17 Arranged with Supplier Inc. to obtain a time extension on the past-due account payable, re: the purchase on September 17, by signing a 90-day note bearing interest at 10%. Borrowed $90,000.00 from Bank of Nova Scotia by signing a 60 day, 11% note payable. Recorded the information from the payroll journal for the month of December and recorded the employer's portion of the payroll deductions. I Dec. 20 - Dec. 28 -> Gross Salaries CPP withheld El withheld Income Tax withheld Medical Insurance premiums withheld Net Pay $38,000.00 763.504 518.40 7,600.00 2,760.00 26,358.10 -> Dec. 31 On December 1, 2019 the company began selling a product on which they offer a 155% Focus 500 words CIK English (Canada) one-year warranty for parts and labour. The total cash sales for the month of December were $50,000 plus HST @ 13%. The cost of goods sold was $30,000. (Don't forget to record these sales!) The company has estimated that the warranty costs will be approximately 3% of sales. The actual warranty costs for the month of December were $300 for parts and $150 for labour.|| Recorded the accrued interest on the outstanding notes payable. Prepare a separate journal entry to record the accrued interest for each note. Dec. 31 20214 Jan. 15 + Paid the remittance due to the Receiver General for Canada, for the employee deductions for December. I Paid the note dated October 17, 2020 Jan??* 1 Feb??* Paid the note dated December 26, 20204 Required: Prepare the journal entries to record the above transactions. Explanations are NOT required, but please assign DATES to all of the entries and show me your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts