Question: please show clean work PROBLEMS PG-1 Consolidated workpaper (downstream sales, Intercompany receivabla/payable) Sion Corporation, a 90 percent-owned subsidiary of Pop Corporation, was acquired on January

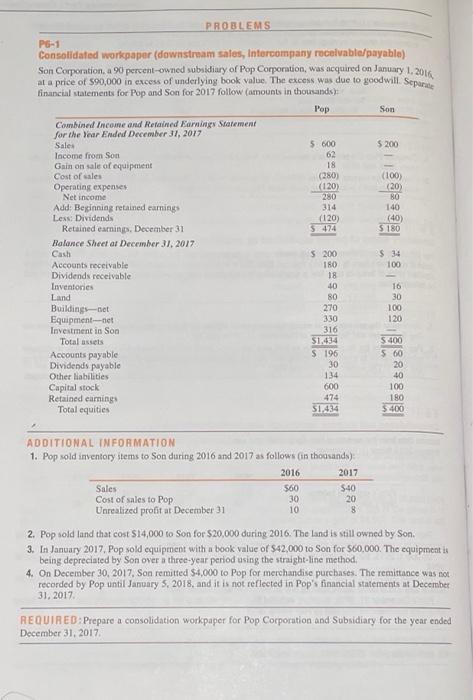

PROBLEMS PG-1 Consolidated workpaper (downstream sales, Intercompany receivabla/payable) Sion Corporation, a 90 percent-owned subsidiary of Pop Corporation, was acquired on January 1, 2016 at a price of $90,000 in excess of underlying book value. The excess was due to goodwill. Separatie financial statements for Pop and Son for 2017 follow (amounts in thousands) Pop Son Combined Income and Refined Earning Statement for the Near Ended December 31, 2017 Sales 5 600 $ 200 Income from Son 62 Gain on sale of equipment 18 Cost of sales (280) (100) Operating expenses (120) (20) Net income 280 Add Beginning retained eaming 314 140 Less Dividends (120) (40) Retained earning, December 31 5474 $ 180 Balance Sheet ar December 31, 2017 Cash 5200 $ 34 Accounts receivable 180 100 Dividends receivable 18 Inventories 40 16 Land 80 30 Buildingsnet 270 100 Equipment--net 330 120 Investment in Son 316 Total assets $1.434 $400 Accounts payable S 196 5 60 Dividends payable 30 20 Other liabilities 134 40 Capital stock 600 100 Retained earnings 474 180 Total equities 51,434 5400 Sales ADDITIONAL INFORMATION 1. Pop sold inventory items to Son during 2016 and 2017 as follows (in thousands) 2016 2017 560 $40 Cost of sales to Pop 30 20 Unrealized profit of December 31 10 8 2. Pop sold land that cost 514,000 to Son for $20,000 during 2016. The land is still owned by Son. 3. In January 2017, Pop xold equipment with a book value of 42,000 to Son for 560,000. The equipment in being depreciated by Son over a three-year period using the straight-line method 4. On December 30, 2017, Son remitted $4,000 to Pop for merchandise purchases. The remittance was not recorded by Pop until January 5, 2018, and it is not reflected in Pop's financial statements ut December 31, 2017 REQUIRED: Prepare a consolidation workpaper for Pop Corporation and Subsidiary for the year ended December 31, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts