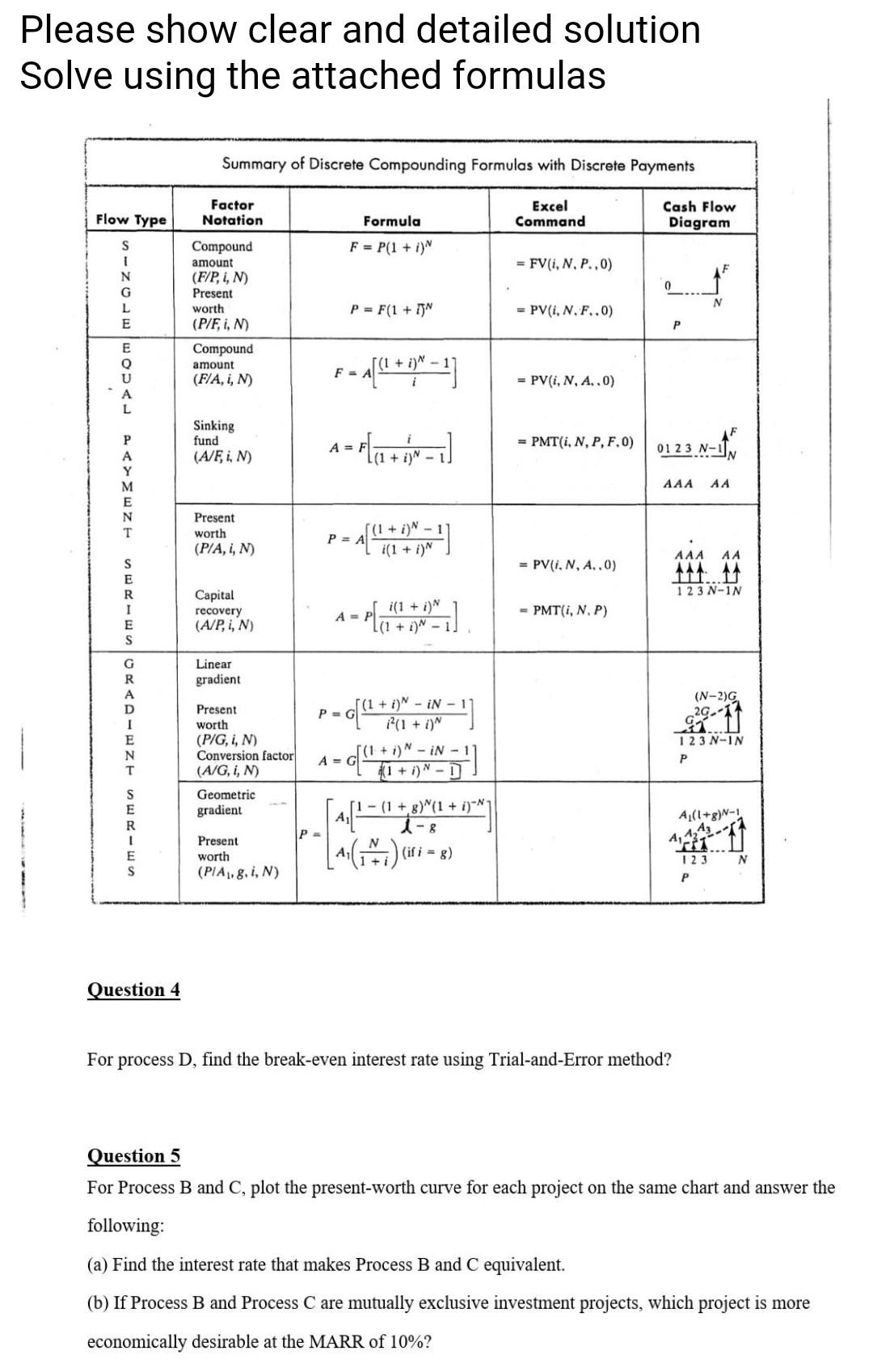

Question: Please show clear and detailed solution Solve using the attached formulas Summary of Discrete Compounding Formulas with Discrete Payments Flow Type Factor Notation Excel Command

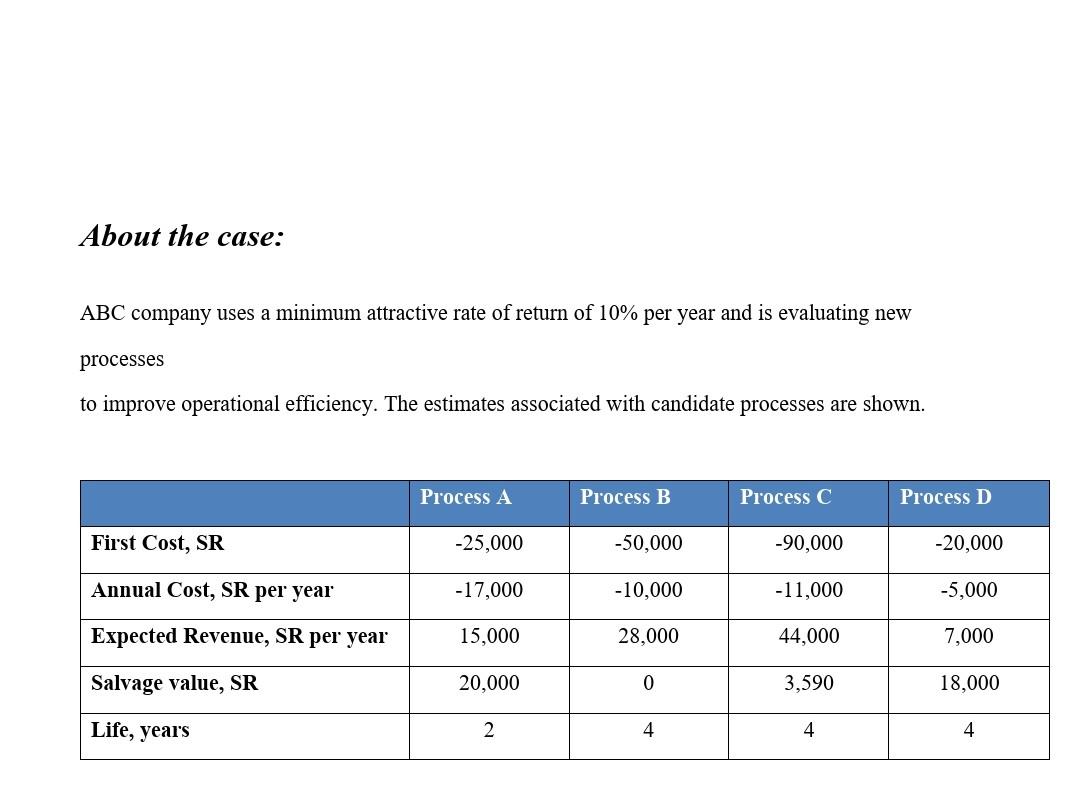

Please show clear and detailed solution Solve using the attached formulas Summary of Discrete Compounding Formulas with Discrete Payments Flow Type Factor Notation Excel Command Cash Flow Diagram Formula F = P(1 + i) = FV(i, N, P.,0) S 1 N G L E Compound amount (F/P, 1, N) Present worth (P/F, 1, 1) Compound amount (F/A, i, N) . P = F(1 + 7 = PV(i, N. F..0) E (1 + i) - WOD - ---(+1-4 = PV(i, N, A..0) A Sinking fund (A/F, 1, N) A 1 = a +iW-1] = PMT(i, N, P, F.0) =1 A 01 2 3 N- Zm3 AAA AA M E N Present worth (P/A,1,N) P= [(1 + i)N- (1 + i)" S E = PV(i. N, A..0) AAA AA 14. 1 2 3 N-IN Capital recovery (A/P, i, N) A-ray i(1 + i) = - - PMT, N.P) G Linear gradient (N-2) - [14 29.11 - OYA-ZE-wan Present worth (P/G, i, N) Conversion factor (A/G, i, N) Geometric gradient |(1 + i)" - iN - PEG 2(1 + i)" N-in-1 A = G (1 + i) - LG 1 2 3 N-IN P A1(1+8)N-1 P 11- (1 + 8) (1 + i)-N Ail 1-8 N A (if i = g) 4,4,4, Present worth (PIA,8,1,N) HT 1 2 3 P N Question 4 For process D, find the break-even interest rate using Trial-and-Error method? Question 5 For Process B and C, plot the present-worth curve for each project on the same chart and answer the following: (a) Find the interest rate that makes Process B and C equivalent. (b) If Process B and Process C are mutually exclusive investment projects, which project is more economically desirable at the MARR of 10%? About the case: ABC company uses a minimum attractive rate of return of 10% per year and is evaluating new processes to improve operational efficiency. The estimates associated with candidate processes are shown. Process A Process B Process C Process D First Cost, SR -25,000 -50,000 -90,000 -20,000 Annual Cost, SR per year -17,000 -10,000 -11,000 -5,000 Expected Revenue, SR per year 15,000 28,000 44,000 7,000 Salvage value, SR 20,000 0 3,590 18,000 Life, year's 2 4 4 4 Please show clear and detailed solution Solve using the attached formulas Summary of Discrete Compounding Formulas with Discrete Payments Flow Type Factor Notation Excel Command Cash Flow Diagram Formula F = P(1 + i) = FV(i, N, P.,0) S 1 N G L E Compound amount (F/P, 1, N) Present worth (P/F, 1, 1) Compound amount (F/A, i, N) . P = F(1 + 7 = PV(i, N. F..0) E (1 + i) - WOD - ---(+1-4 = PV(i, N, A..0) A Sinking fund (A/F, 1, N) A 1 = a +iW-1] = PMT(i, N, P, F.0) =1 A 01 2 3 N- Zm3 AAA AA M E N Present worth (P/A,1,N) P= [(1 + i)N- (1 + i)" S E = PV(i. N, A..0) AAA AA 14. 1 2 3 N-IN Capital recovery (A/P, i, N) A-ray i(1 + i) = - - PMT, N.P) G Linear gradient (N-2) - [14 29.11 - OYA-ZE-wan Present worth (P/G, i, N) Conversion factor (A/G, i, N) Geometric gradient |(1 + i)" - iN - PEG 2(1 + i)" N-in-1 A = G (1 + i) - LG 1 2 3 N-IN P A1(1+8)N-1 P 11- (1 + 8) (1 + i)-N Ail 1-8 N A (if i = g) 4,4,4, Present worth (PIA,8,1,N) HT 1 2 3 P N Question 4 For process D, find the break-even interest rate using Trial-and-Error method? Question 5 For Process B and C, plot the present-worth curve for each project on the same chart and answer the following: (a) Find the interest rate that makes Process B and C equivalent. (b) If Process B and Process C are mutually exclusive investment projects, which project is more economically desirable at the MARR of 10%? About the case: ABC company uses a minimum attractive rate of return of 10% per year and is evaluating new processes to improve operational efficiency. The estimates associated with candidate processes are shown. Process A Process B Process C Process D First Cost, SR -25,000 -50,000 -90,000 -20,000 Annual Cost, SR per year -17,000 -10,000 -11,000 -5,000 Expected Revenue, SR per year 15,000 28,000 44,000 7,000 Salvage value, SR 20,000 0 3,590 18,000 Life, year's 2 4 4 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts