Question: please show clear steps Question #7 Suppose there are 3 bonds with the following characteristics. There is a 1-year Treasury bond with a face value

please show clear steps

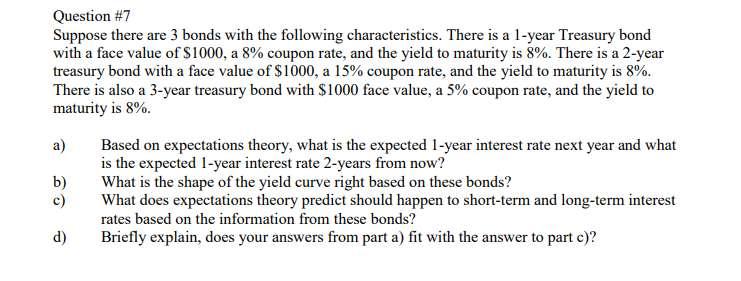

Question #7 Suppose there are 3 bonds with the following characteristics. There is a 1-year Treasury bond with a face value of $1000, a 8% coupon rate, and the yield to maturity is 8%. There is a 2-year treasury bond with a face value of $1000, a 15% coupon rate, and the yield to maturity is 8%. There is also a 3-year treasury bond with $1000 face value, a 5% coupon rate, and the yield to maturity is 8%. a) Based on expectations theory, what is the expected 1-year interest rate next year and what is the expected 1-year interest rate 2-years from now? b) What is the shape of the yield curve right based on these bonds? c) What does expectations theory predict should happen to short-term and long-term interest rates based on the information from these bonds? d) Briefly explain, does your answers from part a) fit with the answer to part c)? Question #7 Suppose there are 3 bonds with the following characteristics. There is a 1-year Treasury bond with a face value of $1000, a 8% coupon rate, and the yield to maturity is 8%. There is a 2-year treasury bond with a face value of $1000, a 15% coupon rate, and the yield to maturity is 8%. There is also a 3-year treasury bond with $1000 face value, a 5% coupon rate, and the yield to maturity is 8%. a) Based on expectations theory, what is the expected 1-year interest rate next year and what is the expected 1-year interest rate 2-years from now? b) What is the shape of the yield curve right based on these bonds? c) What does expectations theory predict should happen to short-term and long-term interest rates based on the information from these bonds? d) Briefly explain, does your answers from part a) fit with the answer to part c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts