Question: Please show clear work, steps, and divide sections into 1, 2, 3 rather than mixing everything up. Consider a 9.5 year bond with a 4%

Please show clear work, steps, and divide sections into 1, 2, 3 rather than mixing everything up.

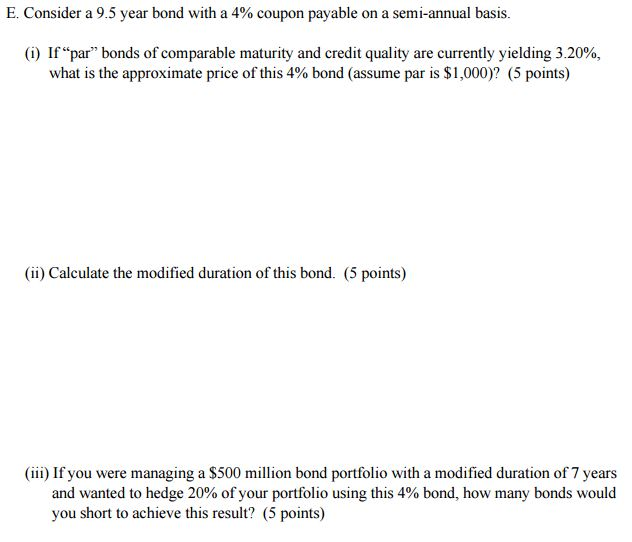

Consider a 9.5 year bond with a 4% coupon payable on a semi-annual basis. (i) If "par" bonds of comparable maturity and credit quality are currently yielding 3.20%, what is the approximate price of this 4% bond (assume par is exist1,000)? (ii) Calculate the modified duration of this bond. (iii) If you were managing a exist500 million bond portfolio with a modified duration of 7 years and wanted to hedge 20% of your portfolio using this 4% bond, how many bonds would you short to achieve this result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts