Question: PLEASE SHOW CLEARLY THE ANSWER BOTH ROUNDED & NOT ROUNDED FOR A B C D. THANK YOU (Individual or component costs of capital) Compute the

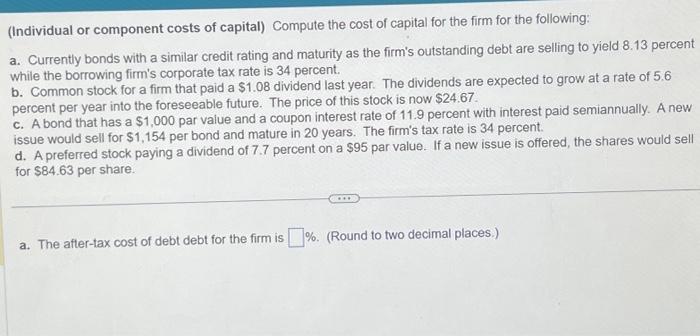

(Individual or component costs of capital) Compute the cost of capital for the firm for the following: a. Currently bonds with a similar credit rating and maturity as the firm's outstanding debt are selling to yield 8.13 percent while the borrowing firm's corporate tax rate is 34 percent. b. Common stock for a firm that paid a $1.08 dividend last year. The dividends are expected to grow at a rate of 5.6 percent per year into the foreseeable future. The price of this stock is now $24.67. c. A bond that has a $1,000 par value and a coupon interest rate of 11.9 percent with interest paid semiannually. A new issue would sell for $1,154 per bond and mature in 20 years. The firm's tax rate is 34 percent. d. A preferred stock paying a dividend of 7.7 percent on a $95 par value. If a new issue is offered, the shares would sell for $84.63 per share. a. The after-tax cost of debt debt for the firm is \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts