Question: please show complete solution Problem 7. A taxpayer has the following stock transactions not traded in the stock exchange: Date 12/1/2020 1/12/2021 3/18/2021 8/14/2021 11/17/2021

please show complete solution

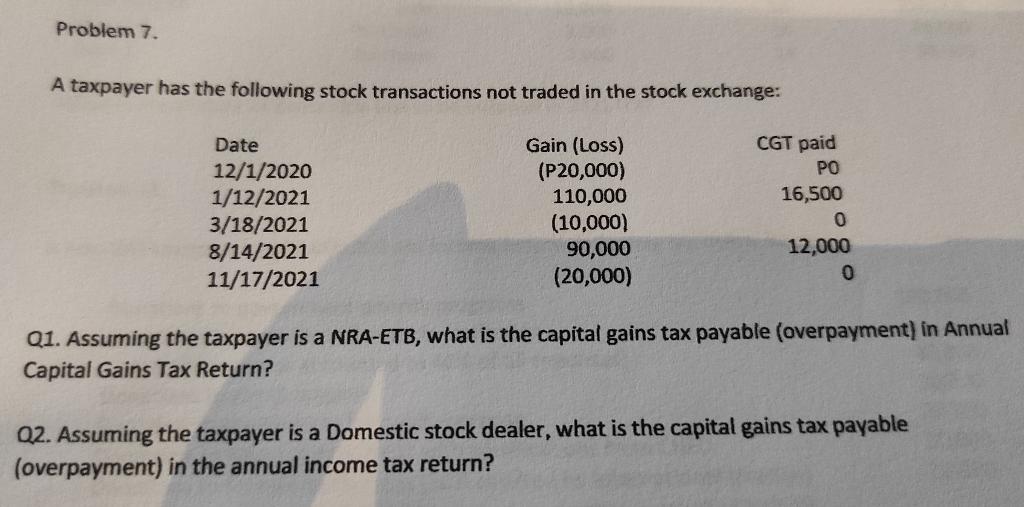

Problem 7. A taxpayer has the following stock transactions not traded in the stock exchange: Date 12/1/2020 1/12/2021 3/18/2021 8/14/2021 11/17/2021 Gain (Loss) (P20,000) 110,000 (10,000) 90,000 (20,000) CGT paid PO 16,500 0 12,000 0 Q1. Assuming the taxpayer is a NRA-ETB, what is the capital gains tax payable (overpayment) in Annual Capital Gains Tax Return? Q2. Assuming the taxpayer is a Domestic stock dealer, what is the capital gains tax payable (overpayment) in the annual income tax return

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts