Question: Please show COMPLETE working including formulas used, no shortcuts please as I am confused with how to get the answer. Thanks a) b) A company

Please show COMPLETE working including formulas used, no shortcuts please as I am confused with how to get the answer. Thanks

a)

b)

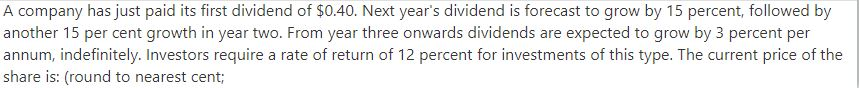

A company has just paid its first dividend of $0.40. Next year's dividend is forecast to grow by 15 percent, followed by another 15 per cent growth in year two. From year three onwards dividends are expected to grow by 3 percent per annum, indefinitely. Investors require a rate of return of 12 percent for investments of this type. The current price of the share is: (round to nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts