Question: Please show computation (do not use excel) Complete Solution (PW & IRR METHOD) Question 1 25 Points Upload the picture of your complete solutions. ...

Please show computation (do not use excel) Complete Solution (PW & IRR METHOD)

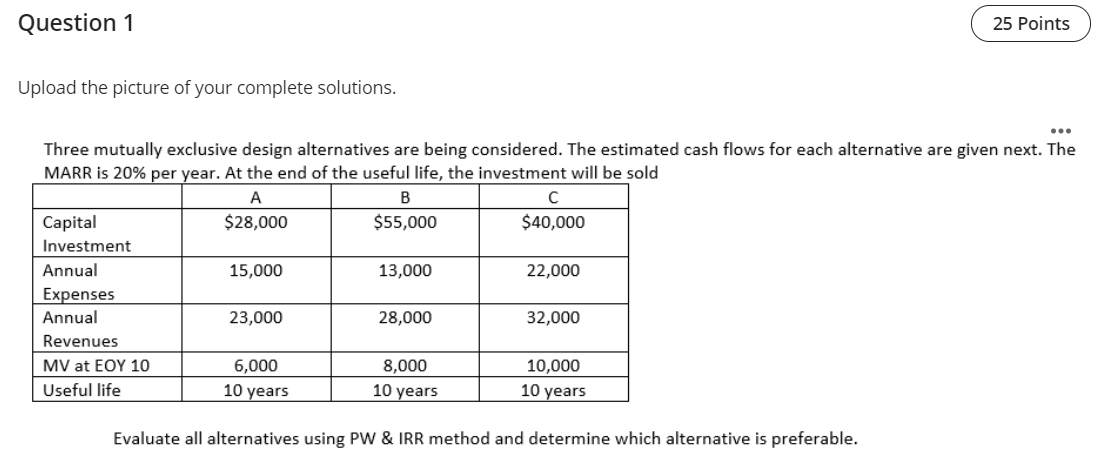

Question 1 25 Points Upload the picture of your complete solutions. ... Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given next. The MARR is 20% per year. At the end of the useful life, the investment will be sold A B Capital $28,000 $55,000 $40,000 Investment Annual 15,000 13,000 22,000 Expenses Annual 23,000 28,000 32,000 Revenues MV at EOY 10 6,000 8,000 10,000 Useful life 10 years 10 years 10 years Evaluate all alternatives using PW & IRR method and determine which alternative is preferable. Question 1 25 Points Upload the picture of your complete solutions. ... Three mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given next. The MARR is 20% per year. At the end of the useful life, the investment will be sold A B Capital $28,000 $55,000 $40,000 Investment Annual 15,000 13,000 22,000 Expenses Annual 23,000 28,000 32,000 Revenues MV at EOY 10 6,000 8,000 10,000 Useful life 10 years 10 years 10 years Evaluate all alternatives using PW & IRR method and determine which alternative is preferable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts