Question: Please show detailed steps . No excel. Everything manual with a calculator. You have 100 million dollars in your investment account and choose to keep

Please show detailed steps . No excel. Everything manual with a calculator.

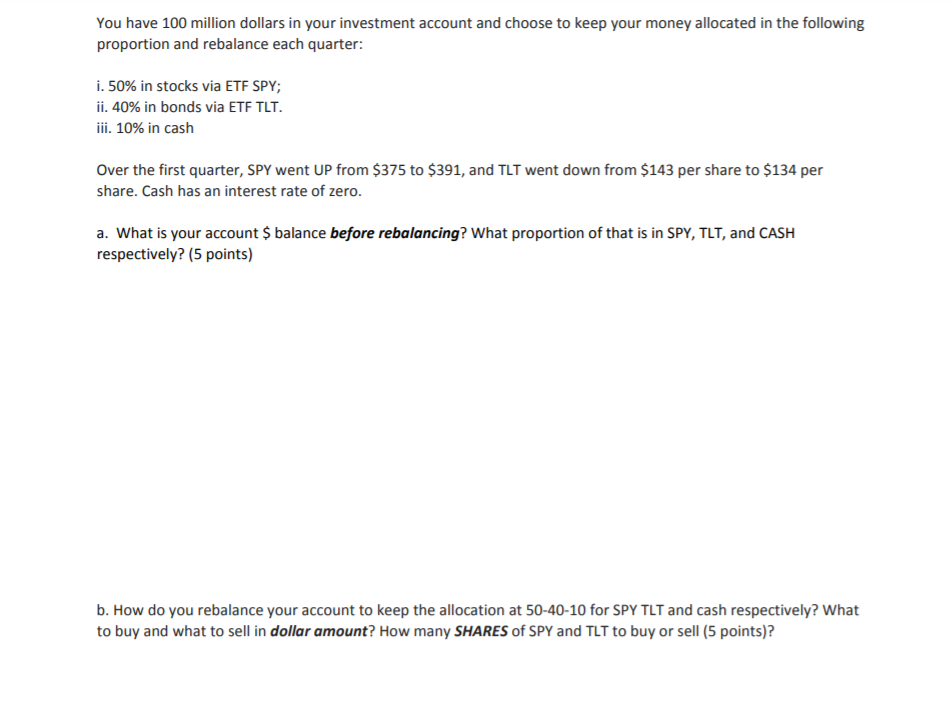

You have 100 million dollars in your investment account and choose to keep your money allocated in the following proportion and rebalance each quarter: i. 50% in stocks via ETF SPY; ii. 40% in bonds via ETF TLT. iii. 10% in cash Over the first quarter, SPY went UP from $375 to $391, and TLT went down from $143 per share to $134 per share. Cash has an interest rate of zero. a. What is your account $ balance before rebalancing? What proportion of that is in SPY, TLT, and CASH respectively? (5 points) b. How do you rebalance your account to keep the allocation at 50-40-10 for SPY TLT and cash respectively? What to buy and what to sell in dollar amount? How many SHARES of SPY and TLT to buy or sell (5 points)? You have 100 million dollars in your investment account and choose to keep your money allocated in the following proportion and rebalance each quarter: i. 50% in stocks via ETF SPY; ii. 40% in bonds via ETF TLT. iii. 10% in cash Over the first quarter, SPY went UP from $375 to $391, and TLT went down from $143 per share to $134 per share. Cash has an interest rate of zero. a. What is your account $ balance before rebalancing? What proportion of that is in SPY, TLT, and CASH respectively? (5 points) b. How do you rebalance your account to keep the allocation at 50-40-10 for SPY TLT and cash respectively? What to buy and what to sell in dollar amount? How many SHARES of SPY and TLT to buy or sell (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts