Question: Please show detailed steps . No excel. Everything manual with a calculator. here are the previous questions as requested... I. stock has mean of 8%

Please show detailed steps . No excel. Everything manual with a calculator.

here are the previous questions as requested...

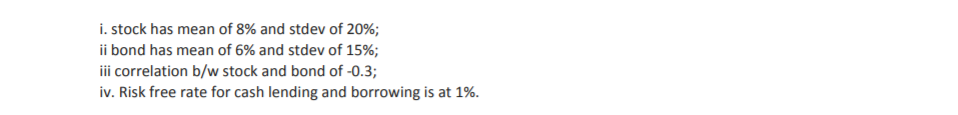

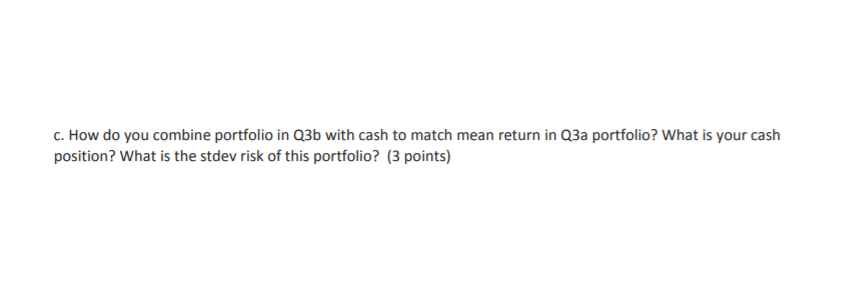

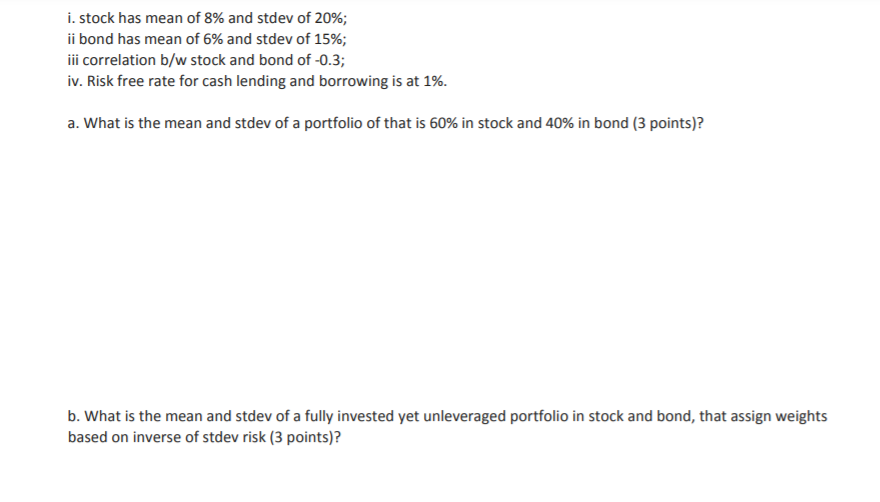

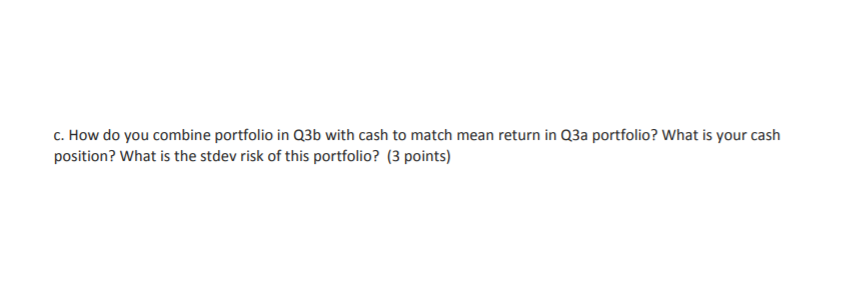

I. stock has mean of 8% and stdev of 20%; ii bond has mean of 6% and stdev of 15%; ii correlation b/w stock and bond of -0.3; iv. Risk free rate for cash lending and borrowing is at 1%. c. How do you combine portfolio in Q3b with cash to match mean return in Q3a portfolio? What is your cash position? What is the stdev risk of this portfolio? (3 points) I. stock has mean of 8% and stdev of 20%; ii bond has mean of 6% and stdev of 15%; ii correlation b/w stock and bond of -0.3; iv. Risk free rate for cash lending and borrowing is at 1%. a. What is the mean and stdev of a portfolio of that is 60% in stock and 40% in bond (3 points)? b. What is the mean and stdev of a fully invested yet unleveraged portfolio in stock and bond, that assign weights based on inverse of stdev risk (3 points)? c. How do you combine portfolio in Q3b with cash to match mean return in Q3a portfolio? What is your cash position? What is the stdev risk of this portfolio? (3 points) I. stock has mean of 8% and stdev of 20%; ii bond has mean of 6% and stdev of 15%; ii correlation b/w stock and bond of -0.3; iv. Risk free rate for cash lending and borrowing is at 1%. c. How do you combine portfolio in Q3b with cash to match mean return in Q3a portfolio? What is your cash position? What is the stdev risk of this portfolio? (3 points) I. stock has mean of 8% and stdev of 20%; ii bond has mean of 6% and stdev of 15%; ii correlation b/w stock and bond of -0.3; iv. Risk free rate for cash lending and borrowing is at 1%. a. What is the mean and stdev of a portfolio of that is 60% in stock and 40% in bond (3 points)? b. What is the mean and stdev of a fully invested yet unleveraged portfolio in stock and bond, that assign weights based on inverse of stdev risk (3 points)? c. How do you combine portfolio in Q3b with cash to match mean return in Q3a portfolio? What is your cash position? What is the stdev risk of this portfolio? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts