Question: please show detailed work, thank you!! 2. For example, we have a firm has FCF of S20M with an unlevered cost of capital of 10%,

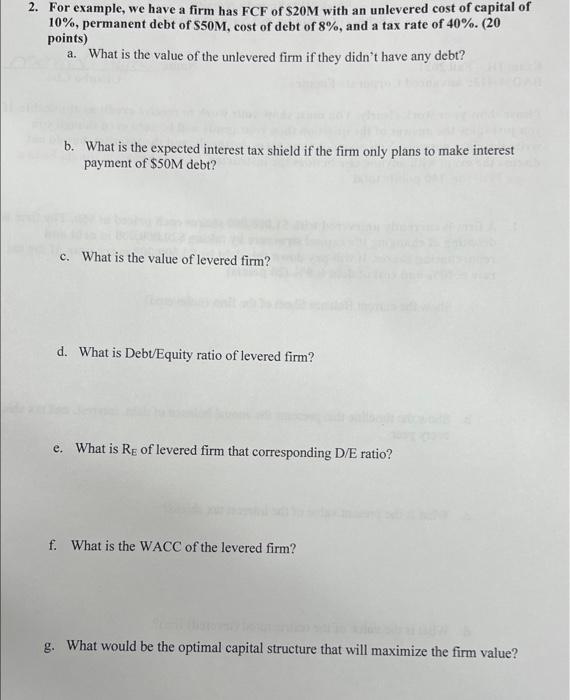

2. For example, we have a firm has FCF of S20M with an unlevered cost of capital of 10%, permanent debt of $50M, cost of debt of 8%, and a tax rate of 40%. (20 points) a. What is the value of the unlevered firm if they didn't have any debt? b. What is the expected interest tax shield if the firm only plans to make interest payment of $50M debt? c. What is the value of levered firm? d. What is Debt/Equity ratio of levered firm? e. What is Re of levered firm that corresponding D/E ratio? f. What is the WACC of the levered firm? g. What would be the optimal capital structure that will maximize the firm value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts