Question: Please show each mathematical step with formula and explain. thank you In a very simplistic example, a bank has only two positions on its balance

Please show each mathematical step with formula and explain. thank you

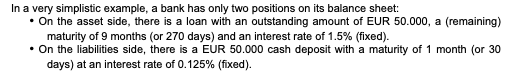

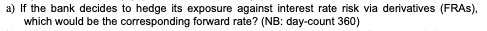

In a very simplistic example, a bank has only two positions on its balance sheet: - On the asset side, there is a loan with an outstanding amount of EUR 50.000, a (remaining) maturity of 9 months (or 270 days) and an interest rate of 1.5% (fixed). - On the liabilities side, there is a EUR 50.000 cash deposit with a maturity of 1 month (or 30 days) at an interest rate of 0.125% (fixed). a) If the bank decides to hedge its exposure against interest rate risk via derivatives (FRAs), which would be the corresponding forward rate? (NB: day-count 360 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts