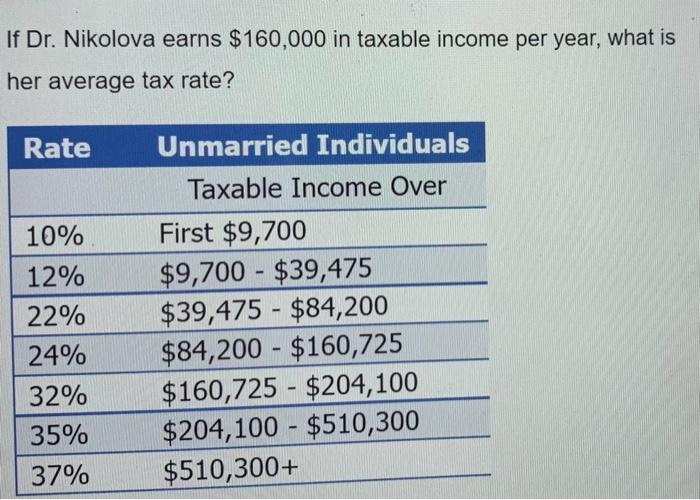

Question: please show each step!!! all one question! If Dr. Nikolova earns $160,000 in taxable income per year, what is her average tax rate? Rate -

If Dr. Nikolova earns $160,000 in taxable income per year, what is her average tax rate? Rate - 10% 12% 22% 24% 32% 35% 37% Unmarried Individuals Taxable Income Over First $9,700 $9,700 - $39,475 $39,475 - $84,200 $84,200 - $160,725 $160,725 - $204,100 $204,100 - $510,300 $510,300+

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts