Question: please show each step and explain. Thank you ! Also the Management Fees are The annual contributions will equal 2 percent of committed capital for

please show each step and explain. Thank you ! Also the Management Fees are The annual contributions will equal 2 percent of committed capital for the first 10 years of the fund. These contributions will be paid quarterly.

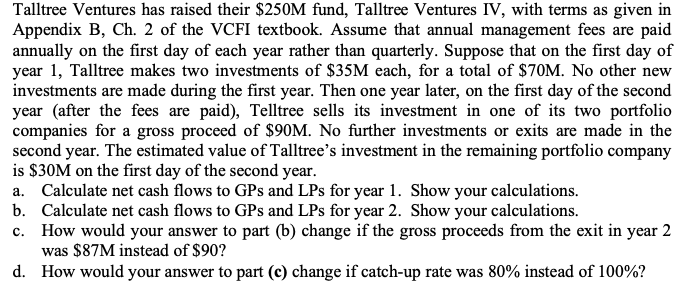

Talltree Ventures has raised their $250M fund, Talltree Ventures IV, with terms as given in Appendix B, Ch. 2 of the VCFI textbook. Assume that annual management fees are paid annually on the first day of each year rather than quarterly. Suppose that on the first day of year 1, Talltree makes two investments of $35M each, for a total of $70M. No other new investments are made during the first year. Then one year later, on the first day of the second year after the fees are paid), Telltree sells its investment in one of its two portfolio companies for a gross proceed of $90M. No further investments or exits are made in the second year. The estimated value of Talltree's investment in the remaining portfolio company is $30M on the first day of the second year. a. Calculate net cash flows to GPs and LPs for year 1. Show your calculations. b. Calculate net cash flows to GPs and LPs for year 2. Show your calculations. c. How would your answer to part (b) change if the gross proceeds from the exit in year 2 was $87M instead of $90? d. How would your answer to part (c) change if catch-up rate was 80% instead of 100%? Talltree Ventures has raised their $250M fund, Talltree Ventures IV, with terms as given in Appendix B, Ch. 2 of the VCFI textbook. Assume that annual management fees are paid annually on the first day of each year rather than quarterly. Suppose that on the first day of year 1, Talltree makes two investments of $35M each, for a total of $70M. No other new investments are made during the first year. Then one year later, on the first day of the second year after the fees are paid), Telltree sells its investment in one of its two portfolio companies for a gross proceed of $90M. No further investments or exits are made in the second year. The estimated value of Talltree's investment in the remaining portfolio company is $30M on the first day of the second year. a. Calculate net cash flows to GPs and LPs for year 1. Show your calculations. b. Calculate net cash flows to GPs and LPs for year 2. Show your calculations. c. How would your answer to part (b) change if the gross proceeds from the exit in year 2 was $87M instead of $90? d. How would your answer to part (c) change if catch-up rate was 80% instead of 100%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts