Question: Please show each step and/or explanation!! 7. Jose, single, reports the following items for 2021: Salary $44,000 $ 1244 loss on stock acquired 3 years

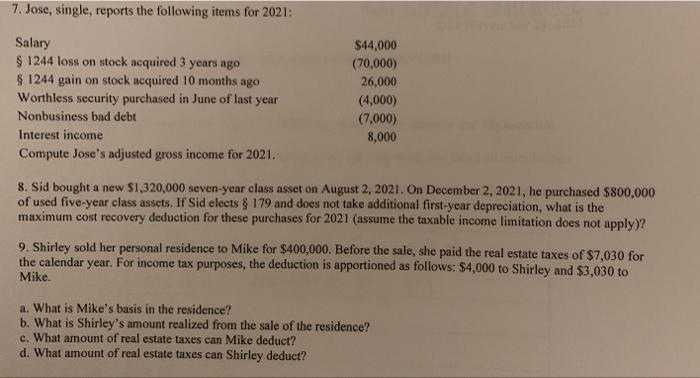

7. Jose, single, reports the following items for 2021: Salary $44,000 $ 1244 loss on stock acquired 3 years ago (70,000) $ 1244 gain on stock acquired 10 months ago 26,000 Worthless security purchased in June of last year (4,000) Nonbusiness bad debt (7,000) Interest income 8,000 Compute Jose's adjusted gross income for 2021. 8. Sid bought a new S1,320,000 seven-year class asset on August 2, 2021. On December 2, 2021, he purchased $800,000 of used five-year class assets. If Sid elects $ 179 and does not take additional first-year depreciation, what is the maximum cost recovery deduction for these purchases for 2021 (assume the taxable income limitation does not apply)? 9. Shirley sold her personal residence to Mike for $400,000. Before the sale, she paid the real estate taxes of $7,030 for the calendar year. For income tax purposes, the deduction is apportioned as follows: $4,000 to Shirley and $3,030 to Mike. a. What is Mike's basis in the residence? b. What is Shirley's amount realized from the sale of the residence? c. What amount of real estate taxes can Mike deduct? d. What amount of real estate taxes can Shirley deduct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts